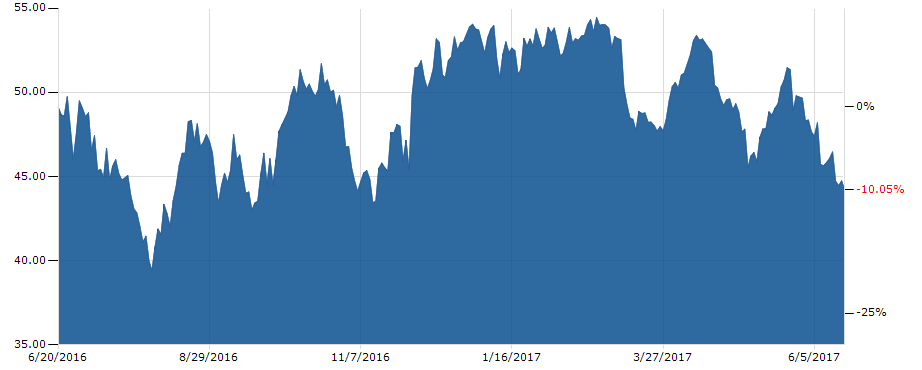

Those who believe that the bears are here to stay are buying into the sell-off this morning. As of 10:45 a.m., distillates and RBOB are trading down near 3 cents, while WTI crude sits right under $43 dollars per barrel. Those who like looking at graphs can see below that WTI crude just hit its lowest point since November of last year. What was so significant about the month of November you ask? Let me take you back in time.

On November 30th, OPEC met in Vienna to discuss whether production cuts would be extended or not and if so, how much production would need to be reduced? OPEC and some major non-OPEC nations decided to extend cuts for at least 6 more months, which did bring some support to oil prices. However, it is being realized that these limitations placed on production could be merely a temporary solution for keeping the supply glut monster away.

Now that oil rigs are showing the biggest consecutive gains in close to 30 years, it’s no surprise that some are starting to let go of the horns and instead are taking a ride downtown on the big furry tractor (bear). According to funding partner John Kilduff of energy hedge fund Again Capital, the market has been waiting for numerical proof that OPEC is achieving its goal to reduce the supply glut. Last week, the International Energy Agency stated that there is a chance that inventories will not reach levels required to impact the supply glut until the end date for the extended production cuts, if not later.

In Other News:

- Libya + Nigeria ramping up production

- US Production still up

- API Inventory report comes out this evening

- DOEs at 10:30 a.m. tomorrow will be telling for where market is headed next