This week Marathon Petroleum Company has agreed to purchase Andeavor, a large oil refiner for $23.3 billion. Bloomberg stated, “The offer, payable in either cash or shares, values Andeavor at about $152.27 a share, the companies said in a statement on Monday. That’s about a 24 percent premium over Friday’s closing price.”

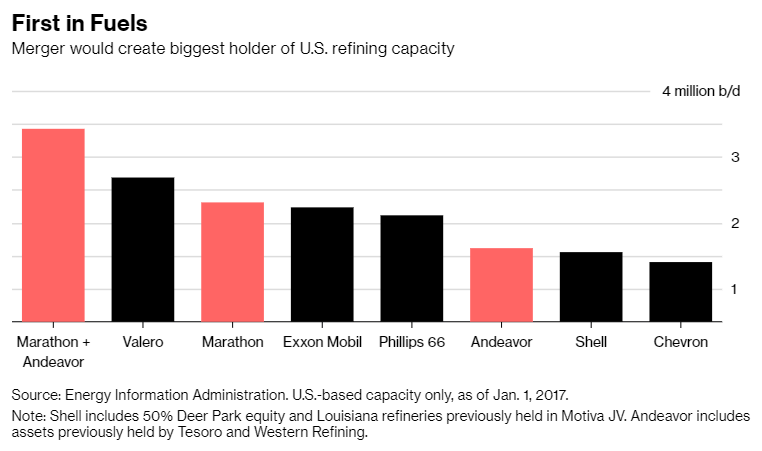

The merger is significant to the industry because this now creates the largest U.S. refinery surpassing rival Valero. Marathon Chief Executive Gary Heminger is expected to run the combined company and Andeavor CEO Gregory Goff would join Marathon as executive vice chairman, as noted by the Wall Street Journal.

According to Reuters, “shale oil fields have pushed U.S. crude production to record highs and industry experts argue operations that have capacity to refine light crude like Andeavor will be better positioned to take advantage of the boom. Andeavor also runs refineries in Alaska, California, Minnesota, New Mexico, North Dakota, Texas, Utah and Washington which should complement Marathon’s largely Mid-West and Gulf Coast-based operations.”

Marathon is now one of the biggest refiners in the United States and their strategies will have major impact on US supply. According to the WSJ, “if the deal closes, Marathon will become the largest U.S. refiner, with 16 plants and about 3 million barrels a day of capacity, a massive pipeline network through two partnerships it would control and a retail network of thousands of gas stations, according to Tudor Pickering Holt & Co. The company would control about 16% of U.S. refining capacity.”

Source:

https://www.cnbc.com/2018/04/30/marathon-petroleum-to-acquire-andeavor.html

https://www.wsj.com/articles/marathon-petroleum-to-buy-andeavor-for-more-than-20-billion-1525054049