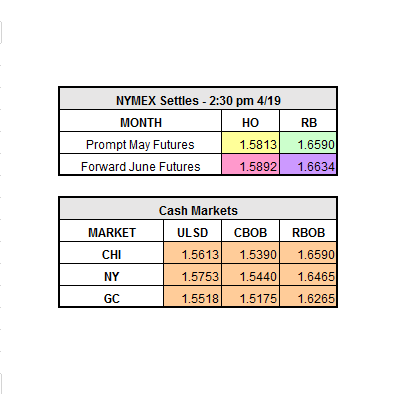

The market fell yesterday afternoon after the split DOE statistics. Gasoline dropped to a three-week low after the steady rise in price. We saw draws across the board except in gasoline, which built 1.9 million barrels; crude drew 1 million barrels and distillate drew 1.9 million barrels. Crude runs rose 351,000 bpd, distillate fell 457,000 bpd to 4.177 million bpd, and gasoline is at 9.223 million bpd. Yesterday, front month heating oil closed down $0.0406 to $1.5813/gal, front month RBOB closed $0.0520 to $1.6590/gal, and WTI Crude closed down $1.97 to $50.44/bbl.

With talks of production cuts, domestic refining capacity is 1 million bpd higher than last year at this time. We may see an oversupply because of the all-time high crude inventories in the U.S. The United States has been preparing for the cuts that OPEC has been talking about in order to stabilize crude stocks worldwide.

Also worth noting is the Shell and Motiva split, which has been scheduled for May 1st. Between the two suppliers, three major refineries were run, along with many other properties around the United States.

Motiva Gains:

- Saudi Aramco will keep the Motiva name

- 603,000 bpd refinery in Port, Texas (largest in the United States)

- 24 distribution terminals

- License to sell Shell brand gasoline and diesel in Texas, parts of Mississippi River Valley, and Southeast and Mid-Atlantic markets

Shell Gains:

- Owner of the two other refineries in Louisiana (472,700 bpd capacity)

- 11 distribution terminals

- Branded Shell stations in Florida, Louisiana and U.S. Northeast

- $2.2 billion balancing payment from Aramco/Motiva

The market is creeping back up as of 10:35 a.m. ET; May HO is up 50 points to $1.5863/gal and May RBOB is up just over a penny to $1.6695/gal.