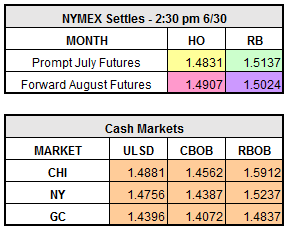

Oil prices are up this morning across all indices ahead of the July 4th Independence Day holiday tomorrow. June closed out this past Friday with its seventh consecutive up day and early indications are that we’re headed for an eighth straight up day. With the forward month now rolling to August, Friday closed with the settles at $46.04/barrel for crude, $1.4831/gallon for heating oil and $1.5137/gallon for RBOB.

Friday, the latest Baker-Hughes rig count data showed a drop by two rigs, the first drop since January of this year. In addition, U.S. government data showed crude output falling in April for the first time this year. “Sentiment has turned and I think we should be going up. I don’t think it’s going to last, but the momentum at the moment is with the bulls,” said oil strategist Tamas Varga of PVM Oil Associates.

Overall, oil prices are still down 14% for the year as rising output from the U.S., Nigeria and Libya have more than offset global demand. Data on the June OPEC production numbers show an increase of 280,000 bpd when factoring in OPEC-exempt countries Nigeria and Libya, versus an agreed-upon OPEC expectation of a 1.2 million barrels per day cut. “At current output levels, OPEC will not succeed in eliminating the inventory overhang completely by year’s end,” noted Commerzbank analysts.

As a reminder, this week’s inventory stats will be one day later than usual. The American Petroleum Institute will release its numbers Wednesday afternoon and the Energy Information Administration’s stats will come out Thursday morning.