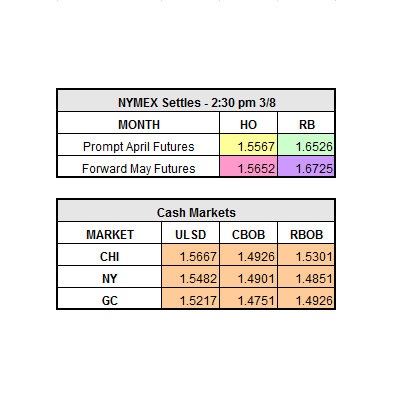

We have seen big changes in the market since last Thursday. Yesterday the April HO Contract closed at $1.5567/gal down $0.0572 and the April RBOB Contract closed at $1.6526/gal, down $0.0272. It is interesting to note in the last two weeks, subsequent to the DOE Reports, front month heating oil has closed over 5 cents per gallon. WTI Crude fell by 5.38% on Wednesday, dropping almost three cents to close at $50.28. The market continued its slide early this morning and hit a low of $1.5209/gal for April HO, and $1.6067/gal for April RBOB. As of 10:07 a.m. ET the market is climbing its way back up, currently trading at $1.5448/gal for April HO, and $1.6393/gal for April RBOB.

Crude seems to be the champion this week in the battle of the bulls and the bears with another large build. According to Thomson Reuters News, U.S crude stocks hit a record high at 528.4 million bbls. Crude built by 8.2Mb, which was more than four times the expected build. It will be interesting to see how long the U.S. Crude build streak of 2017 will continue. From a Cash Market standpoint, New York Harbor continues to go stronger which can be attributed to the record low imports and the large crude build. The real question is, will these drops in oil prices recover soon or continue to weaken?