As the Denver Broncos, with Peyton Manning at the helm and probably for the last time, gallop victoriously into the night after bullying the Panthers offense, we enter a new week of trading accompanied by several bearish sentiments:

- Venezuelan oil Minister Eulogio Del Pino has been on tour trying to persuade top oil producers to take action in hopes of increasing the price of crude. Yesterday, no physical signs of an arrangement for OPEC and non-OPEC suppliers to formally discuss the global supply glut emerged from his meeting with Saudi Arabia’s oil minister, although he was quoted by Reuters saying that his meeting was “productive.”

- With oil prices continuing to hover around the low $30/bbl range, top U.S. shale oil companies have yet again cut their budgets for 2016. That’s two budget cuts within the first two months of the year, with an average reduction of 40%—primarily affecting spending on new wells and projects.

- Additionally, Baker Hughes reported on Friday the seventh straight weekly decline in the U.S. oil rig count, down 31 to 467. At this time last year there were 1140 active oil-drilling rigs domestically.

- Even with headlines of a missile launch from North Korea (geopolitical news that would normally prop up the futures market), the market showed little-to-no response as the global oversupply remains the top market factor.

- Interesting side note: recent analysis indicates that if every oil producer worldwide intended to help increase the value of a barrel of crude, it would only take a 2% total global supply cut to increase the barrel price by $30. Obviously, OPEC is more intent on keeping new production offline in the short term.

Driving enthusiasts, however, are “driving on cloud nine.” With regular gasoline prices on average 37 cents lower than a year ago, top independent refiners, such as Valero and Phillips66, are pumping out as much product as they can into a demand-driven marketplace. With reports provided by the E.I.A. showing prices at the pump expected to remain under $2/gal throughout 2016, it’s no wonder why drivers are putting on the miles and also buying bigger vehicles.

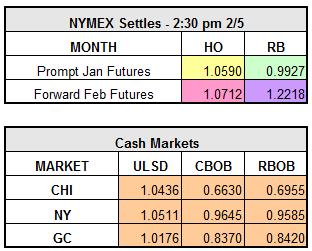

In today’s market we see crude down $0.70 to $30.19, heating oil up $.0077 to $1.0667, and RBOB down $0.0117 to $0.9810. The heat strength is echoed by natural gas on news of cold weather coming to the Northeast this week.