This morning Citigroup Inc. is making a bullish guess for where it thinks prices are headed next, giving support to the ideology which says crude will be near $65 dollars by Q4. The market settled at an 11-day low for oil prices yesterday, but Citigroup is cautioning that this dip in prices is only temporary.

Argument for prices to rise:

- OPEC expected to extend production cuts in May

- Floating crude inventories being brought on-shore for storage now that supplies are lessening

- Failure to fall beneath key support levels in short-term could be bullish

Argument for prices to fall:

- Drillers in the United States added rigs for the 13th week In a row

- EIA estimates U.S. shale production will grow in May by 124,000 bbl/day, with production already at the highest level since November 2015

- Concerns of Russia being behind on production cuts

- Uncertainty surrounding global events involving North Korea, Syria and Iran

While Citigroup believes prices are headed up, it acknowledges this will only be the case if OPEC is successful with extending production cuts, stating that a failure to extend production cuts could send prices “precipitously lower.”

The contrarian view to Citigroup’s would be that production cuts will not be enough to overcome supply levels in the market, especially with the U.S. ramping up production.

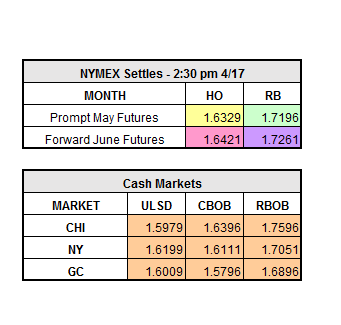

Last week, inventory statistics were bullish, however the market was so over-bought that prices ended up going down. Ahead of the API statistics that will be released tonight, the market is currently down 31 points on distillates, 79 points on RBOB and WTI crude is trading up 3 cents (as of 10:29 a.m. ET).