Oil prices are up this morning ahead of the American Petroleum Institute’s 4:30 p.m. report today. Some traders are adjusting their positions today as they prepare for the statistics to reflect a draw in U.S. crude inventories. Despite Libyan output seeing a recovery, the market seems to be more concerned about whether crude inventories are building or shrinking on a national & global scale.

Although inventories may show a decrease this evening (API.) and tomorrow morning (DOE), it is important to keep in mind that crude failed to break the last resistance level of $50.95. Some feel that prices will need a much bigger push to really start climbing towards $60 again.

UBS analyst Giovanni Staunovo believes production cuts will continue to lessen the supply glut on a global scale, which he anticipates will bring crude prices back above $60 per barrel by sometime in July of 2017.

Keep in mind that there is a very big meeting coming up in May, which is expected to be the “tell-tale” for which direction this market could be headed.

What Else is New?

- Since mid-February, between 10 million and 20 million barrels have left the Caribbean

- Some believe this is a positive sign for lessening the supply glut

- OPEC output fell by 200,000 barrels a day in March

- Analysts anticipate a 1.5 million barrel draw on U.S. crude

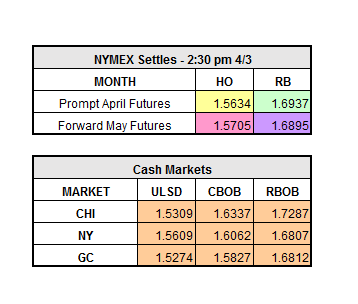

As of 10:13 this morning, HO is up around 1.5 cents, RBOB is up nearly 1 cent and WTI Crude is trading right around $50.50 per barrel.