Everyone involved in the world of commercial trucking is familiar with the term IFTA (International Fuel Tax Agreement), but not everyone knows why IFTA exists and what its intended functions are. IFTA is an agreement between the majority of U.S. states and the majority of Canadian provinces designed to simplify the way that commercial truck or bus drivers who travel through multiple tax jurisdictions report the taxes on the fuel they purchase.

Before the existence of IFTA, drivers were required to purchase a fuel permit from every state that they would be travelling in. Drivers ended up wasting an enormous amount of time stopping and purchasing permits at ports of entry when entering the adjacent state. The wasted time and added out-of-route miles led to state officials from Arizona, Iowa and Washington to come up with a single permit idea. From the early-1980s to the mid-1990s the vast majority of states and provinces adopted the one permit system. As it stands today the only states and provinces that do not recognize the IFTA credentials are Hawaii, Alaska, the District of Columbia, the Northwest Territories, Nunavut and Yukon. According to Paramount Freight Systems “the idea was to have one permit and taxes would be assessed by one authority and distributed to states and localities based upon the number of miles driven in each jurisdiction.”

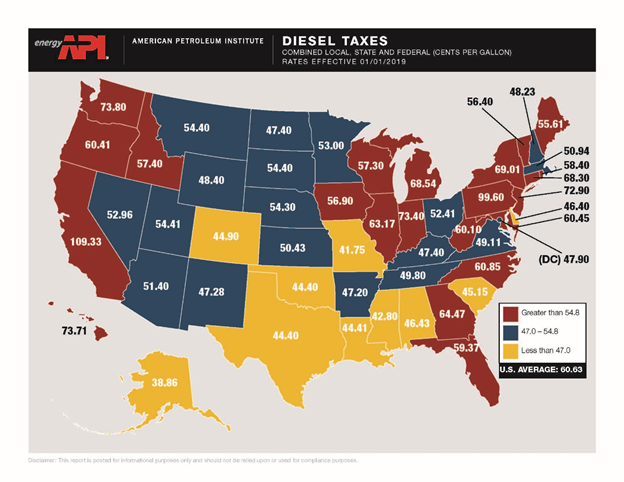

The current process of IFTA has led to a much more efficient system of collecting and distributing fuel taxes, however there can still be quite a bit of confusion. If you fill up at the pump in Pennsylvania, but then drive through Ohio and Indiana on that tank of fuel, the taxes will be distributed to those states actually driven through via IFTA. If you purchase fuel in a low-tax state and then drive through a high-tax state, you may owe taxes at the end of the quarter. The best way to stay consistent on your IFTA taxes is to only purchase the amount of fuel you plan on burning in each state while driving in that state, but this is obviously difficult to predict and can lead to many of the same inefficiencies IFTA was originally created to correct.

While many trucking companies dread the quarterly paperwork required for IFTA, overall it has made paying fuel taxes much more streamlined. The more up-front strategic planning you can do for any particular route, the better off you’ll be when your IFTA report is due.

https://drivepfs.com/fuel-taxes-and-ifta/

https://quickbooks.intuit.com/ca/resources/pro-taxes/international-fuel-tax-agreement-ifta-trucking/

https://www.cdtfa.ca.gov/taxes-and-fees/ifta-ciudft-di-license.htm

https://www.api.org/~/media/Files/Statistics/Diesel-Tax-Map.pdf