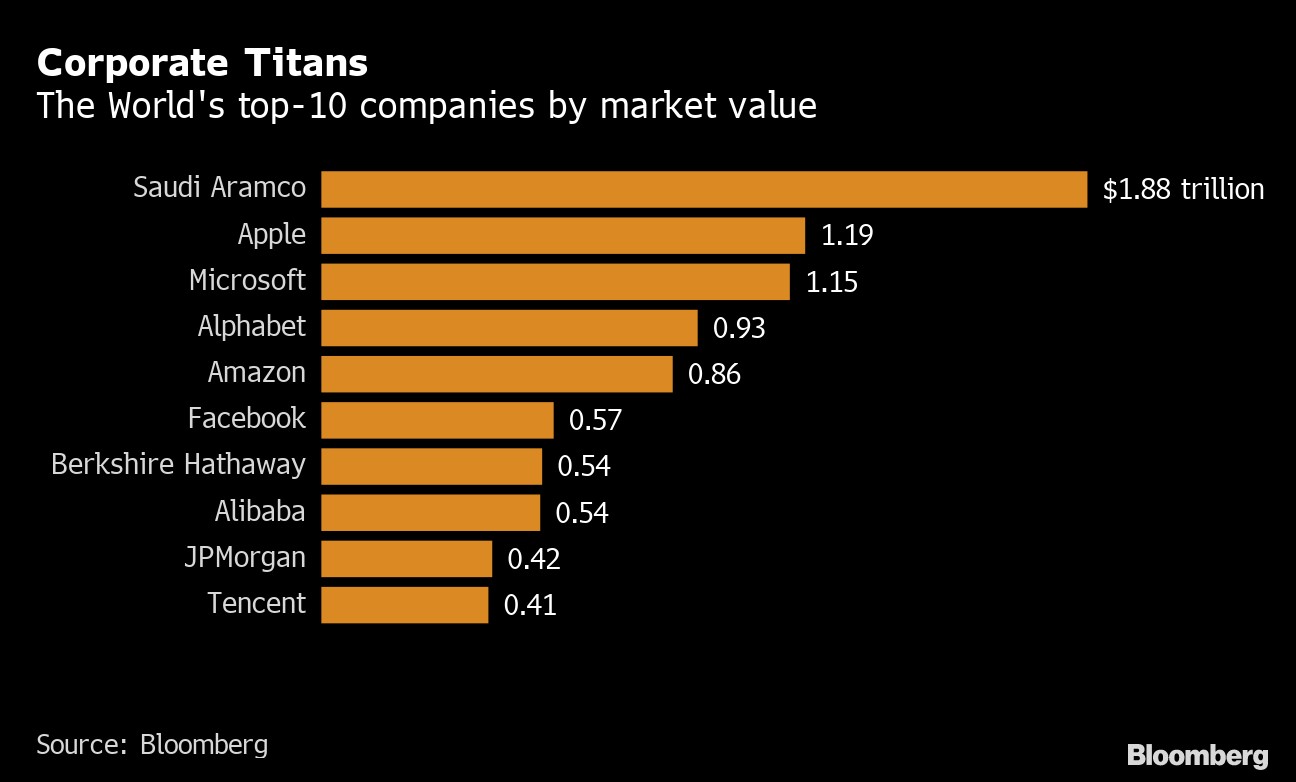

Saudi Aramco had its long-awaited initial public offering (IPO) last week debuting on the Tadawul, Saudi Stock Exchange at a valuation of $1.88 trillion. Aramco’s public debut made it the world’s largest IPO ever, toppling the previous record holder Alibaba in 2014 when they raised $25 billion. When the market closed today in the capital city of Riyadh, Aramco had a market value of over $2 trillion.

The initial concept of a $2 trillion valuation stunned market observers when Crown Prince Mohammed bin Salman made the statement as early as 2016. Global investors and Western advisors did not agree with the figure the Crown Prince wanted to achieve and valued Aramco’s IPO between $1.5-$1.7 trillion. This caused the IPO, originally scheduled in 2018, to be delayed numerous times as financial experts and Saudi leadership contended on the worth of the company responsible for ten-percent of global oil production. Now Saudi Aramco stands as the most valued company in the world. Aramco CEO Amin Nasser said, “We are happy on the results today. And you have seen the market responds to our results, the company will continue to be the leader globally when it comes to the energy sector and at the same time we are looking at sustained and growing dividends to our investors. At the same time we continue our growth strategy, increasing profitability across cycles.”

Part of the growth strategy that Nasser mentioned is referencing the Crown Prince’s Saudi Vision 2030 goals to modernize and diversify efforts to reduce its exclusive dependence on crude oil exports and concentrate efforts on natural gas and petrochemicals. Aramco’s IPO has dominated the headlines as 2019 comes to an end, it will be interesting to see what the future holds for the oil giant as we enter 2020.

https://www.cnbc.com/2019/12/11/saudi-aramco-ipo-shares-surge-as-trading-begins.html

https://www.nytimes.com/2019/12/16/business/energy-environment/saudi-aramco.html

https://oilprice.com/Energy/Natural-Gas/Aramco-Looks-To-Build-An-LNG-Fleet.html