It was not so long ago that we were hearing news of OPEC+ considering an exit from their production cut agreement made in 2017 due to the risk of an over-tightening market. On Monday, officials from Saudi Arabia and Russia reportedly discussed the possibility of oil prices crashing below $40/barrel. There is a distinct possibility of this happening if no agreement can be resolved on an extension of the aforementioned cuts.

According to OilPrice.com, Vladimir Putin commented last week “Of course Saudi Arabia wants oil prices to remain higher,” the Interfax news agency quoted Mr. Putin saying. “But we have no such need due to the more diversified nature of the Russian economy.” These comments are seen as speculation of a rift between OPEC and Russia.

In addition, the Saudis are desperate to prevent such a crash in oil prices. In efforts to possibly convince Russia to agree to extending production cuts, Saudi Arabia is considering heavy investments in “multiple” projects in Russia in order to sweeten the deal and get Russia on board.

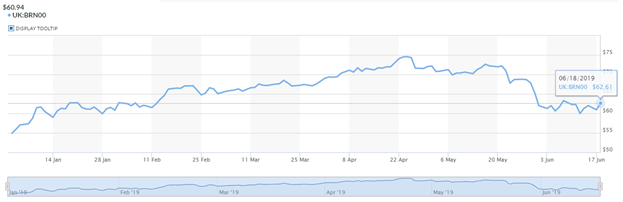

In May the IEA were predicting a significant supply deficit for the second quarter, but since, things have taken a turn for the worse with oil having its worst month since the 2008 financial crisis. Now a growing number of analysts are seeing a supply surplus for next year even if output from Iran and Venezuela do not rebound. S&P Global Platts estimate a surplus of 400,000 bpd, the EIA are estimating 100,000 bdp surplus and the HIS Markit are looking for a 800,000-bpd surplus.

According to Oilprice.com the reason is that demand is cratering and U.S. shale is still expected to grow. The global economy is decelerating, with manufacturing activity around the world slowing down.

Assuming OPEC+ decides to extend the production cuts, the decision will go a long way in shielding against a dramatic selloff. Commerzbank recently downgraded their third-quarter forecast for Brent crude down to $66 from $73 but also noted that they are “keeping their year-end forecast in place as they are convinced that OPEC and Russia will do everything in their power to prevent an oversupply and ensure higher prices.” The bank noted that while Putin is generally satisfied with current prices he has indicated that Russia and OPEC will make a joint decision in the end, suggesting a cut agreement will eventually occur.

https://www.marketwatch.com/investing/future/brn00/charts?countrycode=uk

https://oilprice.com/Energy/Oil-Prices/OPECs-Struggle-To-Avoid-40-Oil.html