Read More

OPEC+ Predicts Oil Market Deficit in 2021

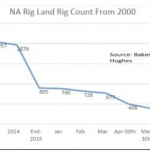

Oil and gas explorations remain sluggish and failing to rebound as expected. At $40+ a barrel and positive market indicator would historically promote conditions for the industry to recover, however there has been no indication of a recovery to speak of. The new normal seems to be a slim, budget conscious, and efficient industry soup […]

Read More

The National Oil Corporation in Libya (NOC) is eager to reopen one of their main export hubs this week, marking the first movement from the OPEC member since oil terminals were placed under force majeure at the beginning of this year after the occupation of the Libyan National Army (LNA). As the blockade reaches into […]

Read More

As we near the end of May, we will put behind us one of the most bullish rallies for the WTI crude oil contract in history with crude jumping almost 75% this month alone. Of course, with WTI prices currently trading at $33.33/barrel, that’s not saying much, as it is widely perceived the breakeven price […]

Read More

OPEC+ came to an agreement earlier this month to institute record-breaking production cuts of nearly 10 million barrels per day. The production cuts were set to take effect on May 1st, but some members have taken it upon themselves to start earlier. Kuwait and Saudi Arabia have both made the decision to start scaling back […]

Read More

OPEC+ reached an agreement to cut 9.7 million barrels per day (mb/d) beginning in May which is a record-breaking cut, but it still may not be enough to stabilize the market. U.S. Secretary of Energy Dan Brouillette said that the total number of cuts globally, when you add in all the non-OPEC countries, should be […]

Read More

Much like some of the most daunting roller coasters in the world, crude oil has provided adrenaline building hill climbs, steep drops, twists, and turns. Historically, you will be hard pressed to find a more erratic fuel market than the one we have witnessed over the past few months. COVID-19 has sparked drastic demand destruction, […]

Read More

The first quarter of 2020 has absolutely rocked global oil markets due to COVID-19, an OPEC+ supply and price dispute as well as a global economic recession. What happens next is still unknown, but with global storage on the brink of filling up and demand destruction nearing 20 million bpd, the global oil industry will […]

Read More

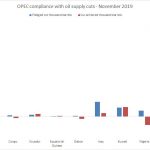

The OPEC meeting that concluded today in Vienna ended with ministers approving productions cuts for the first quarter of 2020. The cuts for OPEC+ will be increased from 1.2 million bpd to 1.7 million bpd. A 500,000 bpd cut should be painless for the organization as they are currently at over-compliance with the cuts as […]

Read More

A recent survey conducted by Reuters found that OPEC oil output has dropped during the month of November from October by 110,000 barrels per day (bpd). The cause is from Angola Production fell due to maintenance, along with Saudi Arabia halted supply output before the initial public offering of state-owned Saudi Aramco.

Read More