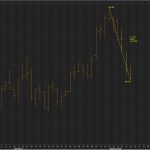

Oil prices fell more than 1% yesterday hitting 14 month lows after reports of an increase in U.S. inventories along with surging shale output.

Read MoreGoing Down?

Oil prices fell more than 1% yesterday hitting 14 month lows after reports of an increase in U.S. inventories along with surging shale output.

Read More

As we approach the holidays, here are a few things oil and gas companies are juggling:

Read More

Crude prices have been surging the last few weeks with the expected loss of Iranian supply beginning November 4th. With that, the U.S. has been ramping up pressure on OPEC to increase production in an attempt to lower oil prices.

Read More

Yesterday, the United States and Mexico settled on new concessions that will make changes to the current North American Free Trade Agreement (NAFTA). The hope is to improve upon the U.S. $69-billion trade deficit with Mexico.

Read More

The oil market is rallying today primarily because of a sizable crude oil draw reported by the DOE, a softening dollar, and bullish OPEC comments.

Read More

Commodity and global equity markets got smoked yesterday due to a surge in the U.S. dollar index which was perpetuated by fears of Turkish contagion and a surprise build in crude oil inventories.

Read More

Oil prices continue to be range bound until the market bulls or bears take control. As of this morning, there were more bullish than bearish factors which is resulting in green across the board for the moment.

Read MoreThe bulls and bears have been battling it out with some violent intra-day price reversals as of late and today is no exception.

Read More

On Saturday OPEC and non-OPEC producers agreed to raise production by 1 million barrels per day (bpd). Perhaps more important than that, they agreed to return to 100% compliance of the previously agreed upon production cuts of 1.8 million bpd. Production was lagging from struggling countries, i.e., Venezuela, Angola and Libya which effectively equated to […]

Read More

On May 22nd we were hoping for a market correction prior to the holiday weekend. On that day the front month NYMEX RBOB contract settled at $2.2636. Climbing from May 2nd, close @ $2.0803. A whooping $0.18 price move inflicting severe pain on your local gas station distributor leaving retail gasoline margins negative in some markets and […]

Read More