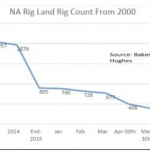

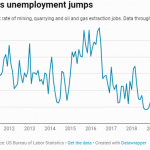

Following a brutal year for their balance sheets, the world’s biggest oil companies are anticipating a windfall of cash flow this year. Prices have rallied significantly over the past month or so, and the massive cost-cutting from last year positions some of the biggest International Oil Companies (IOCs) to reap the benefits of high crude […]

Read MoreWill big oil achieve record cash flow?