September Market Update Summary

- OPEC+ Plan to Increase Output October

- Refinery Operations

- Federal Reserve

- US Inventory Update

- Energy Outlook

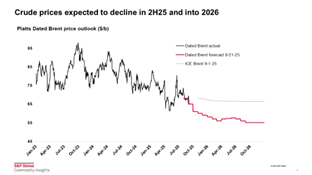

OPEC+ plan to increase output 137,000 b/d in Oct continues BEARISH trend for Dated Brent

OPEC+ announced Sept. 7 a 137,000 b/d increase in output for October. Which is in addition to the previously announced 2.2 million b/d of OPEC+ voluntary cuts. This move is BEARISH for oil prices. In its announcement, OPEC+ said the increase comes amid a “steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories.” Although largely bearish in nature, the increase in production was already priced in by the oil market.

The overall fundamental view of the oil market remains bearish with seasonal refinery maintenance (reducing demand) and increasing oil production (increasing supply). China added nearly 120 million barrels (530,000 b/d) to storage over the last eight months, one of the largest increases since the COVID-19 pandemic in 2020. It’s not believed that China can continue increasing inventories at this rate, which would put additional pressure on the crude market price.

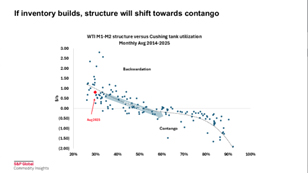

The market reaction to production changes has reduced the prompt futures market backwardation. With the market moving towards contango as it balances additional supply against stagnant demand, which can incentivize further stock building in the West.

Near Term Refinery Outages

Global refinery outages rose to 4.9 million barrels per day during mid-August, which was up 620,000 barrels per day from earlier in the month. This was driven primarily by drone strikes impacting Russian capacity, partially offset by restarts in Latin America and Japan.

US refinery outages were 238,000 barrels per day during the same period, with expectations of a recovery as operations normalize. There were several unplanned cuts during the month at Phillips 66’s Bayway refinery, Valero’s Port Arthur refinery, TotalEnergies’ Port Arthur facility, and Shell’s Norco refinery. Additionally, ongoing scheduled maintenance took place at PBF’s Torrance refinery, Delek’s Big Spring refinery, and Marathon’s Canton refinery – all of which impact the domestic supply and demand balance.

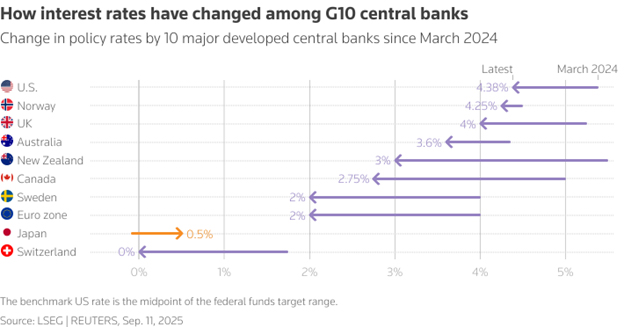

U.S. Fed Chairman Signals September Interest Rate Cut

In August, Federal Reserve Chairman Jerome Powell signaled a dovish stance on monetary policy. Powell’s comments at the Jackson Hole symposium suggested that slowing job growth could lead to an interest rate cut, with the FedWatch tool showing an 85.2% chance of a cut in September.

Although lower interest rates typically support oil demand and weaken the U.S. dollar – both bullish for oil – analysts from S&P Global Commodity Insights said Powell’s remarks were neutral for oil sentiment due to bearish market fundamentals and ongoing uncertainty.

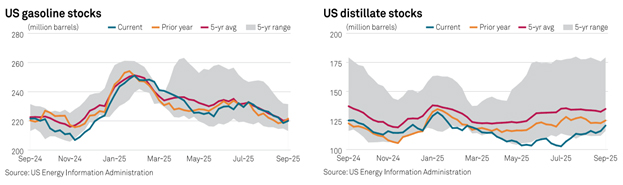

US Inventory Update

The U.S. Energy Information Association (EIA) reported crude oil inventories relatively unchanged for August, with alternating weeks of builds and draws. This is expected to change as the market digests the increase in OPEC production targets.

U.S. diesel stocks rose roughly 3 million barrels during the month, which has been a market headwind during the summer, which has been a period when inventories typically build. The market target on diesel inventory ahead of winter is 125 million barrels, with the market ending August around 120 million barrels. This is anticipated to increase during September, ahead of October refinery turnarounds.

U.S. gasoline stocks drew throughout August, which reflected the demand related to the end of summer driving season. Regional inventories decreased near the end of August as the market approached the gasoline specification changes from Summer RVP (lower) to Winter RVP (higher). This is an annual seasonal shift, where regional inventories should recover once the transition is completed on September 15th.

Energy Outlook

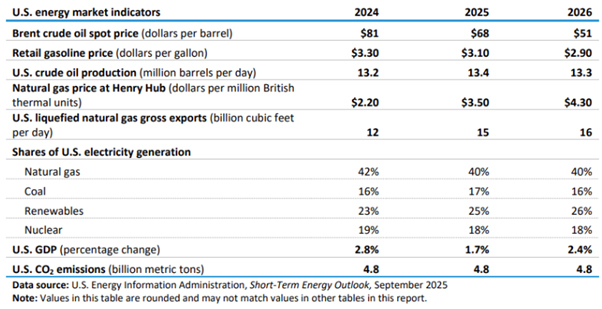

Crude

The U.S. Energy Information Administration (EIA) forecasts Brent crude oil prices will decline from $68 per barrel in August 2025 to $59 in the fourth quarter and around $50 in early 2026. This drop is due to rising global inventories as OPEC+ increases production. Inventories are expected to grow by over 2 million barrels per day through early 2026, though low prices may prompt supply cuts later in the year. Brent is projected to average $51 per barrel in 2026. This outlook was finalized before OPEC+ announced a planned production increase for October.

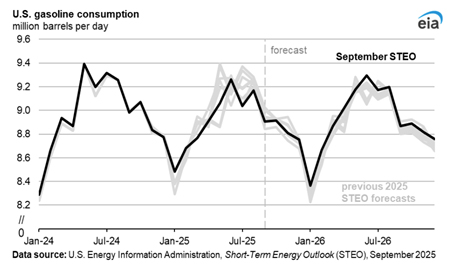

Gasoline

U.S. gasoline demand remained stable but below pre-pandemic levels, largely due to increased vehicle fuel efficiency and slower employment growth. Crude oil prices continued to fall, pushing average retail gasoline prices down to around $3.13 per gallon, a 7.6% year-over-year decline. Despite seasonal summer travel boosting consumption, refinery disruptions—particularly at BP’s Whiting facility—briefly constrained supply in the Midwest. Overall, the market continues to be shaped by steady demand, improving vehicle efficiency, and lower input costs, with supply volatility associated to regional events.

Diesel

U.S. diesel demand softened due to slowing freight and manufacturing activity, as the economy continued shifting toward less diesel-intensive service sectors. On the supply side, falling crude oil prices lowered production costs, but refining margins (crack) remained strong, keeping diesel prices relatively stable. An outage at BP’s Whiting Refinery briefly tightened supply, though inventories rose, signaling adequate coverage. Global diesel consumption also weakened, especially in China, amid economic slowdown. Overall, the market reflected a balance of short-term supply constraints and long-term demand erosion.

Renewables

U.S. biodiesel and renewable diesel markets have faced significant headwinds, primarily driven by changes in federal tax policy. The shift in 2025 from the Blender’s Tax Credit to the Section 45Z Clean Fuel Production Credit eliminated incentives for imports, which decreased biodiesel and renewable diesel imports to plunge to their lowest levels since 2012. Domestic production also declined due to poor blending margins and uncertainty around Renewable Fuel Standard (RFS) mandates (Renewable Volume Obligation), with biodiesel consumption down 40% and renewable diesel down 30% year-over-year.

Sources:

- S&P Global Commodity Insights

- LSEG | Reuters

- US Energy Information Administration (EIA)