October Market Update Summary

- Harvest Season Across the Midwest Kicks Off

- OPEC+ Plan to Increase Monthly Output Again into November

- Israel and Hamas agree to first phase of Peace Deal

- U.S. Total Distillate Inventories Forecast to End 2025-26 Multiyear Lows

- Trump’s Tariff Bombshell Sends Stocks Tumbling

- Energy Forecast

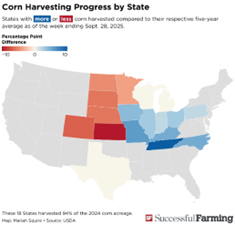

Harvest Season Kicks Off with Strong Yields & Accelerated Pace Across the Region

Harvest is progressing ahead of the five-year average across much of the Midwest. National corn production is forecast at 16.8 billion bushels from a record 98.7 million acres, with yields averaging 186.7 bu/acre. Soybeans are projected at 4.30 billion bushels, with a 53.5 bu/acre yield. As of late September, 18% of corn and 19% of soybeans were harvested nationally.

In Pennsylvania, harvest is staggered due to uneven planting from a wet spring. 6% of corn is harvested (vs. 4% avg), with silage moisture ranging from 69–82% across counties. Ohio is ahead of schedule, with 10% of corn and 21% of soybeans harvested (vs. 7% and 12% avg). Drought has stressed crops, with only 5% of corn and 4% of soybeans rated excellent.

Diesel prices average $3.71/gal nationally, with tight inventories pushing basis up 5–10¢/gal. Propane stocks are strong, but drying demand could spike prices. Western PA and Eastern OH may face rack tightness if weather delays compress harvest, especially with overlapping diesel/propane needs. Demand is expected to drop sharply by late November.

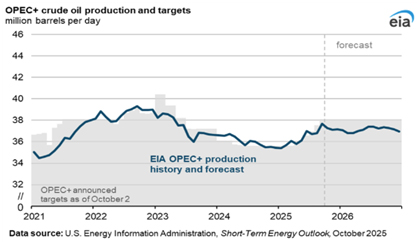

OPEC+ to Increase Output by 137,000 b/d for the Second Month

- OPEC+ decided to raise output ceiling by 137,000 barrels per day.

- Actual production increases may fall short of the agreed target due to complications.

Eight core OPEC+ producers have agreed to raise their collective oil output ceiling by 137,000 barrels per day in November. This marks the start of a gradual reversal of the 1.65 million b/d voluntary cuts made in April 2023.

Despite some concerns about oversupply, this decision was made quickly. However, actual production increases may still fall short of the added volume due to infrastructure bottlenecks and compensation obligations for past overproduction. OPEC+ aims to balance market stability by regaining market share, avoiding a supply glut amid weakening demand.

The group remained vague about future production plans, with the next meeting scheduled for November 2 and nothing announced to follow.

Israel & Hamas Agree to First Phase of Gaza Peace Deal

Israel and Hamas have agreed to the first phase of a peace deal, brokered with U.S. and Qatari mediation. The agreement includes the release of Israeli hostages and Palestinian prisoners, a partial withdrawal of Israeli forces, and the resumption of humanitarian aid to Gaza.

- NYMEX November WTI settled $1.04 lower at $61.51/b and ICE December Brent declined $1.03 to $65.22/b.

- NYMEX November RBOB settled 2.69 cents lower at $1.8826/gal and November ULSD declined 1.10 cents to $2.2803/gal.

Israeli Prime Minister Netanyahu and Hamas leaders have both approved the deal, which still requires final approval from Israel’s cabinet. The full details remain unclear, but the agreement is part of a broader peace plan proposed by President Trump.

Oil prices briefly fell following the announcement, reflecting reduced geopolitical risk in the region. However, key issues like Hamas’s disarmament and Gaza’s future governance are left for future negotiation phases.

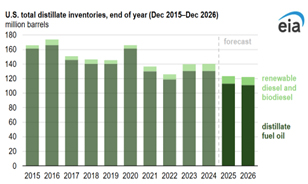

U.S. Total Distillate Inventories to End 2025-26 at Multiyear Lows

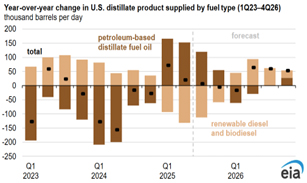

U.S. total distillate inventories are expected to end 2025 and 2026 at lower levels than previous years because of significant inventory draws in 2025, strong export demand, and domestic production declines stemming from refinery closures.

A significant factor in the forecast low inventories is the sharp inventory drawdown in the first half of 2025 (1H25). U.S. total distillate inventories decreased by 17% (about 22 million barrels) during this period, more than the average decrease of 10% (14 million barrels) over the same period in the previous four years.

One major reason for the large inventory draw in 1H25 was reduced supply of renewable diesel and biodiesel because of lower production and lower net imports of fuels.

Trump’s Tariff Bombshell Sends Stocks Tumbling – October 10

- Dow Jones plunged 878 points, marking its worst single day drop since April.

- S&P 500 fell 2.7%, while Nasdaq dropped 3.6%, driven by tech and crypto selloffs.

- U.S. crude oil prices sank over 4%, with WTI breaking below the critical $60/bbl. support level.

- Rare earth stocks surged up to 15%, as supply chain fears intensified following China’s export controls.

On October 10th, markets plunged after President Trump announced a 100% tariff on Chinese imports in response to China’s new export controls on rare earth minerals.

The Dow fell nearly 900 points, while the S&P 500 and Nasdaq dropped 2.7% and 3.6%, respectively—their worst day since April. Tech stocks and Bitcoin were hit especially hard, reflecting investor fears over escalating trade tensions and supply chain disruptions.

The tariffs are also shaking up the petroleum industry, raising costs for imported oil and gas equipment, and threatening domestic production and refining. Strained relations with China, Canada, and Mexico—key players in the global energy supply chain—are prompting some nations to shift energy trade toward China, potentially sidelining U.S. producers and weakening American influence in global markets. Meanwhile, the broader economic slowdown is dampening fuel demand, contributing to a more than 4% drop in U.S. crude prices.

Energy Forecast

Crude

Global oil prices are projected to decline through 2026 due to rising inventories, with Brent crude expected to average $62 per barrel in Q4 2025 and $52 per barrel in 2026. This trend is driven by increasing global liquid fuels production, particularly from non-OPEC+ countries, which will add 2.0 million barrels per day (b/d) in 2025 and 0.7 million b/d in 2026. OPEC+ will also raise output by 0.6 million b/d annually as it gradually unwinds production cuts, though actual production is expected to remain below announced targets, helping to moderate inventory growth and limit the pace of price declines.

Gasoline

U.S. gasoline demand dipped in October to 8.5 million barrels/day, still below pre-pandemic levels due to better fuel efficiency and seasonal travel shifts. WTI crude fell to around $63.67/barrel, pushing retail gas prices down to $3.15/gallon—3.2% lower year-over-year. A fire at Chevron’s El Segundo refinery briefly disrupted California supply, highlighting regional vulnerabilities. Overall, the market reflects softening demand, tech-driven efficiency, and falling input costs, with localized disruptions adding volatility.

Diesel

U.S. diesel demand eased in October due to weaker freight and manufacturing activity, despite falling crude prices, refining margins stayed strong—New York Harbor crack spreads rose to 85¢/gallon amid global supply constraints. National diesel prices averaged $3.71/gallon, up 13¢ year-over-year. Globally, diesel use declined with economic slowdowns in China and Europe, adding to a broader oil surplus and price pressure. The market reflects short-term disruptions and long-term demand erosion.

Sources:

- Oil Price Information Service

- Energy Information Administration (EIA)

- S&P Global Platts

- Reuters

- Argus

- Oildfieldworkers.com

- Agriculture.com