November Market Update

- Heating Degree Day Projection

- Flight Cancellations and Gas Prices

- Inventory Levels

- PA Gas Prices

- Global Oil Demand Projection (Current Policy Influence)

- EIA Short Term Energy Outlook

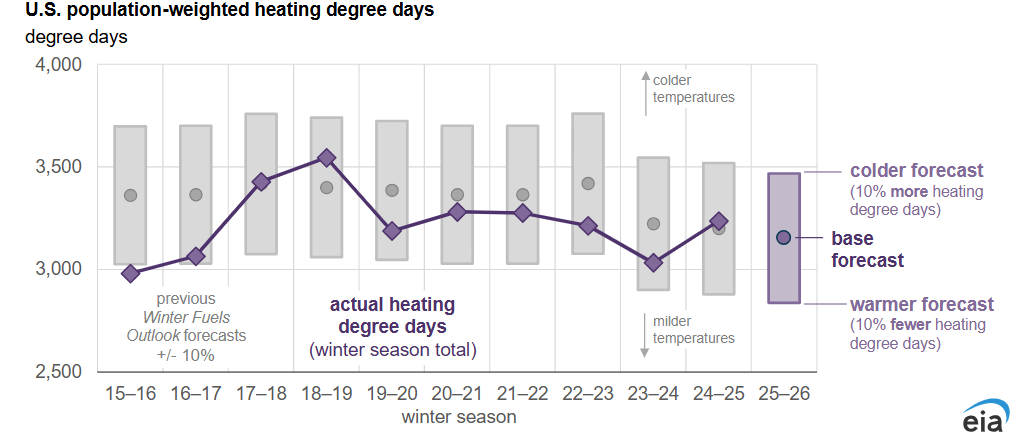

Heating Degree Day Projection Winter 2025-2026

EIA anticipates winter temperatures—and therefore residential energy use—similar to last year. Retail electricity prices are higher nationwide compared to last winter, while natural gas prices remain roughly the same, and propane and heating oil prices are lower.

Fuel inventories are a key focus ahead of winter supply. Currently, U.S. inventories of natural gas and propane are above their five-year (2020–2024) average heading into winter, which has held prices for these fuels below last year’s levels. In contrast, distillate fuel inventories, which include heating oil, are slightly below their five-year average, although PADD 1 is 11% below history. Despite this, theEIA expects heating oil prices to be lower than last year, driven by a forecast for lower crude oil prices.

How Flight Cancellations Could Affect Gas Prices Ahead of Thanksgiving/Holiday Travel

GasBuddy reported, after analyzing more than 12 million reports from 150,000+ gas stations, that the national average gas price rose 4.8 cents last week to $3.03 per gallon. While prices are down 4 cents from a month ago, they remain slightly higher than a year ago. Diesel prices also climbed, increasing 6.5 cents to $3.728 per gallon.

Specific to Pennsylvania, GasBuddy surveyed 5,269 stations to find gasoline prices are 1.3 cents lower than a month ago, and 1.6 cents lower than a year ago.

Patrick De Haan, GasBuddy’s head of petroleum analysis, mentioned a few key factors that could be impacting this.

- Refinery issues at Great Lakes and West Coast

- Government data showed another large drop in supplies

- Thousands of flight cancellations following government closure

Tying this all together, De Haan stated this could cause slight shifts in gasoline demand which may limit any near-term declines.

Inventory Levels

Although OPEC continues to increase production, with another hike planned for December, a slowing global economy combined with rising output has kept oil prices under pressure. China has been purchasing millions of barrels of crude for storage; any halt in Beijing’s buying could trigger a sharp price decline.

Currently, oil prices remain range bound. While last week’s large U.S. crude inventory build weighed on sentiment, news of a potential resolution to the U.S. government shutdown is providing a positive boost to risk appetite.

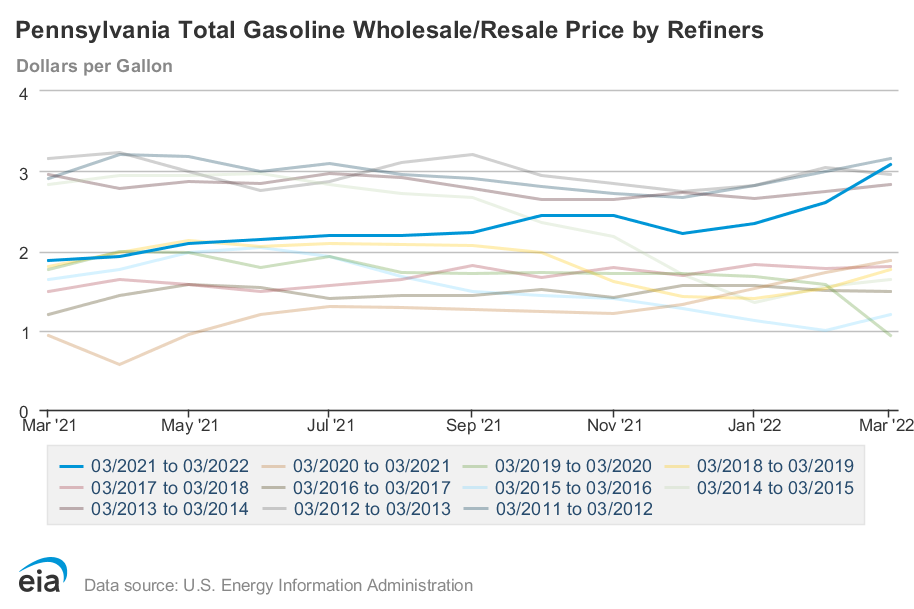

Pennsylvania Gas Prices

Pennsylvania Gas Prices last decade observed Nov 10.

National U.S Average $3.03/g

- Nov. 10, 2024: $3.27/g

- Nov. 10, 2023: $3.61/g

- Nov. 10, 2022: $4.08/g

- Nov. 10, 2021: $3.59/g

- Nov. 10, 2020: $2.45/g

- Nov. 10, 2019: $2.77/g

- Nov. 10, 2018: $2.88/g

- Nov. 10, 2017: $2.79/g

- Nov. 10, 2016: $2.39/g

- Nov. 10, 2015: $2.34/g

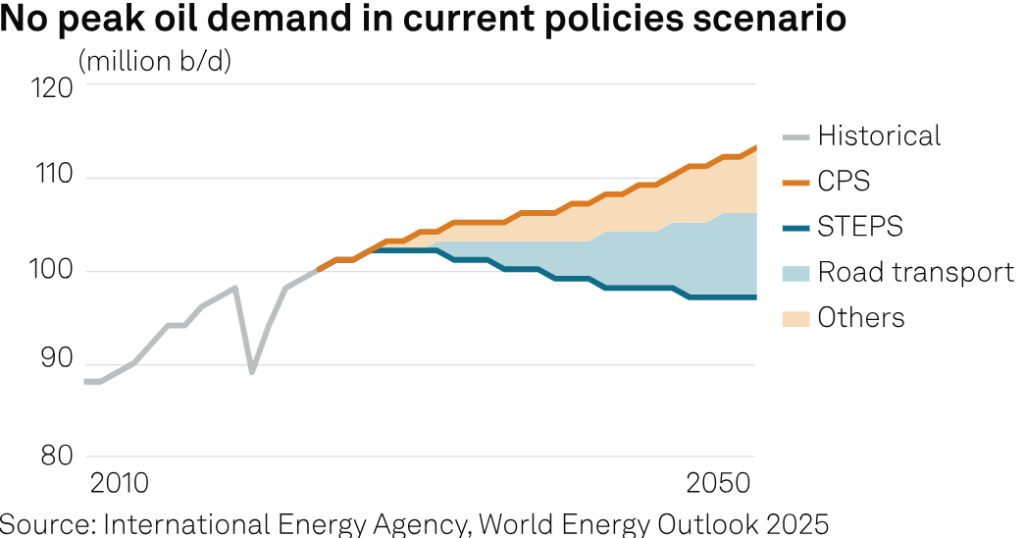

EIA Sees Global Oil Demand Rising Until 2050 Under Current Policies

The International Energy Agency (IEA) has revised its long-term outlook, projecting that global oil demand may not peak until 2050 under current policies. This shift reflects slower adoption of electric vehicles, rising electricity consumption, and weaker climate commitments, particularly in the U.S., which has withdrawn from the Paris Agreement and scaled back renewable investments. Under the IEA’s Current Policies Scenario (CPS), oil demand could grow from 100 million barrels per day in 2024 to 113 million barrels by 2050, with prices exceeding $100 per barrel.

Although the market faces a short-term surplus, declining output from mature fields means an additional 25 million barrels per day of new projects will be needed over the next decade. Global energy demand rose 2% in 2024, with fossil fuels still accounting for nearly 80% of consumption, and emerging economies such as India and Indonesia expected to drive future growth.

EIA Short-Term Energy Outlook

Global Oil Prices

Global inventories are expected to rise through 2026, keeping prices under pressure. Brent crude is projected to average $54/bbl in Q1 2026 and $55 for the year, about $3 higher than last month due to changes in Chinese inventory and Russian sanctions assumptions.

U.S. Gasoline Prices

Retail gasoline prices are forecast to drop below $3.00/gal by 2026, about 10% lower than 2024. Short-term spikes may occur during peak holiday travel periods or following unpredicted automobile travel following mass flight cancellations.

Diesel Prices

Diesel prices will decline more slowly, averaging $3.50/gal by 2026, roughly 7% below 2024. Seasonal freight and holiday demand could cause temporary increases. However, this uptick could be partially offset by reduced consumption from slower construction and agricultural operations in the Northeast.

EV Adoption Falling in America

EV adoption in the U.S. is slowing after years of growth. In early 2025, EVs made up 9.6% of light-vehicle sales, down from over 10%, and only 16% of Americans plan to buy one, while 63% are unlikely. Cost remains the top barrier—59% cite high prices and 62% worry about battery repairs—alongside charging concerns. The end of federal tax credits in September 2025 removed up to $7,500 in incentives, further dampening demand.

Forecasts reflect this shift: Bloomberg cut its 2030 EV market share projection from 48% to 27%, a drop of 14 million units. Hybrids are surging instead, with sales up 39.6% year-over-year, as buyers favor gradual change. Despite more than 75 EV models launched recently, only 23% of Americans believe most cars will be electric within a decade, down from 40% in 2022—highlighting a growing confidence gap.

Sources:

- Platts, Oil Price Information Service

- Energy Information Administration (EIA)

- GasBuddy

- OilPrice.com

- S&P Global