April Market Update Summary

- Current Market

- Tariffs and Volatility

- OPEC+ Supply and Demand Impact

- Refinery Environment

Current Market Review

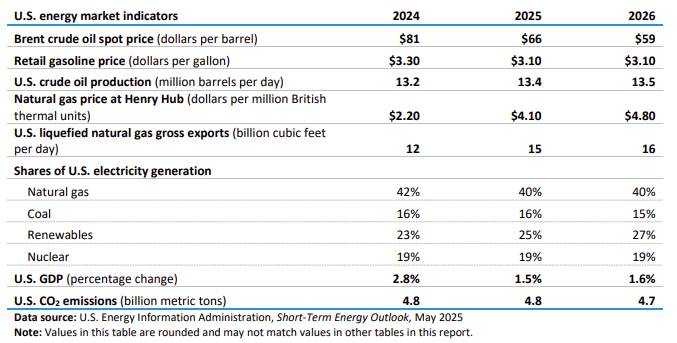

Overall, the market is trying to find its footing, balancing tariffs, soft economies, and increased volatility. In the U.S., gasoline consumption is projected to remain relatively flat in 2025 and decrease slightly in 2026. This trend is attributed to gains in fuel efficiency and slower employment growth, which are expected to offset any potential increases in demand. In contrast, U.S. distillate fuel oil consumption, which includes diesel, is anticipated to rise by 4% in 2025.

Recent reports underscore the impact of tariffs on the energy market (more later). Most current macroeconomic forecasts assume significantly lower tariffs on Chinese products. Many expect the continued impact of tariff adjustments are expected to have offsetting effects on the overall economic forecast, influencing trade dynamics and potentially affecting energy prices and demand.

U.S. crude oil exports are forecasted to rise, despite the increase of OPEC+ production targets, primarily driven the global appetite for varying grades of crude quality. If achieved, this will continue the trend of growing U.S. energy exports. The expansion of export capacity and infrastructure investments are key factors enabling this growth, positioning the U.S. as a significant player in the global energy market.

Tariffs and Volatility

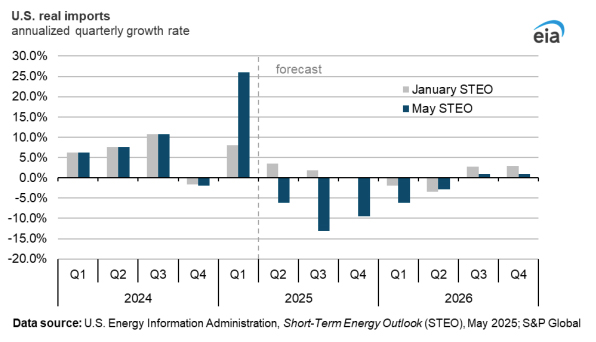

Two significant changes to the market since our last publication, with the most impactful being the announcement over the weekend between U.S. and China. The agreement is for both parties to reduce tariffs for a 90-day period.

The reduction in tariffs, with the U.S. decreasing tariffs on most Chinese imports from 145% to 30% and China reducing tariffs on U.S. goods from 125% to 10%, is a bullish development for oil prices. It is important to note that the tariff reductions do not apply to those imposed during the first Trump administration, meaning Chinese goods exported to the U.S. will still face tariffs between 45% and 50%.

The agreement does not change China’s additional tariffs on U.S. coal, LNG, crude oil, agricultural equipment, and heavy trucks. A 20% tariff on U.S. crude oil imports remains in place, which the market will continue to navigate by balancing supply between other countries. The full impact will depend on the speed of trade resumption and the response of other regions to the changes in trade dynamics

The United States and Britain also announced a trade agreement that maintains the existing 10% tariffs on British exports while reducing U.S. duties on British car exports and expanding agricultural access for both countries. This deal, praised by President Trump and British Prime Minister Starmer, lowers average British tariffs on U.S. goods from 5.1% to 1.8%. This is less impactful than the China announcement, however, this is a positive step towards a broader resolution on the overall tariff landscape.

OPEC+ Impact on Market

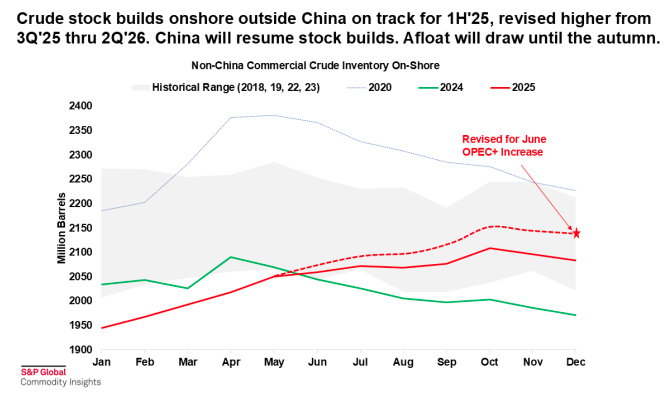

The OPEC+ decision to increase production by 411,000 barrels per day (b/d) in June, following a similar increase in May, has significant implications for diesel and gasoline supply, particularly affecting U.S. refiners. The increased crude production is expected to lead to continued stock builds through the summer, as demand fundamentals are not strong enough to absorb the additional supply. This may result in larger stock builds in the autumn due to refinery maintenance and soft refined product demand. Consequently, there may be an oversupply of diesel and gasoline (depending on refinery decisions), further depressing prices and impacting the profitability of U.S. refiners. The outlook for the latter half of 2025 indicates zero net year-on-year global demand growth for combined gasoline, diesel, jet, and fuel oil, exacerbating the oversupply situation.

Historically, a build-up of 50 million barrels in onshore non-China crude stocks is worth roughly $5 per barrel on price, and the anticipated increase in crude stocks due to OPEC+’s production hike will likely exert downward pressure on prices. This bearish sentiment on oil prices signals broader market instability, affecting the entire supply chain, including U.S. refiners, who will face challenges in maintaining profitability amidst the oversupply and weak demand.

Refinery Outlook

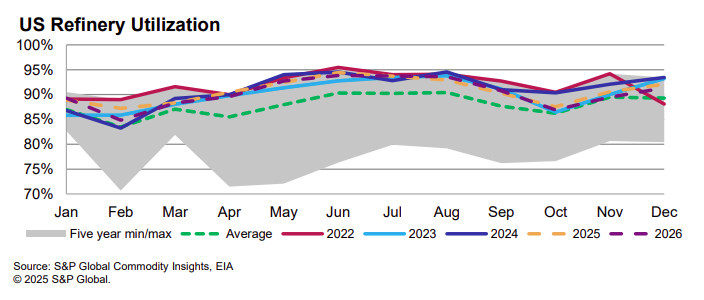

As we approach the summer driving season, global economic conditions and geopolitical events are critical factors that will impact demand. For instance, disruptions in other regions may lead to increased exports of U.S. refined products, thereby affecting domestic supply and prices. The 4-week draw down of U.S. inventories has brought gasoline inventories in-line with prior year averages, and diesel inventories below historical levels. The decline in inventory places the focus on refinery economics and near-term operating decisions. The decline in refinery outages in the U.S. is expected to improve the supply and demand balance for refined products. This will likely help stabilize the impact of operational influences on price volatility. However, unplanned outages in California, such as the fires at Valero Benicia and PBF Martinez, will cause localized disruptions and price increases in the affected areas. Nevertheless, the overall national impact is mitigated by the decline in outages elsewhere.

Planned maintenance and upgrades at various refineries are crucial for ensuring long-term operational efficiency and reliability. For instance, the crude unit and reformer at PBF Martinez have restarted, with the CDU initially running in the 80,000 b/d to 105,000

Guttman Energy, Inc. | 200 Speers Street | Belle Vernon, PA 15012 | T: 724.489.5199 | guttmanenergy.com

b/d range until the end of September. Refineries may invest in capacity enhancements to meet future demand and improve resilience against unplanned outages. This includes upgrading equipment, expanding processing capabilities, and implementing advanced technologies.

Sources;

1) Platts, Oil Price Information Service

2) U.S. Energy Information Administration & U.S. Customers and Border Protection

3) Reuters