March Market Update Summary

• Refinery Closures

• Impact of Tariffs

• Heating Degree Days

• The Transition to Summer Grade Gasoline

Domestic Refining Capacity and Demand

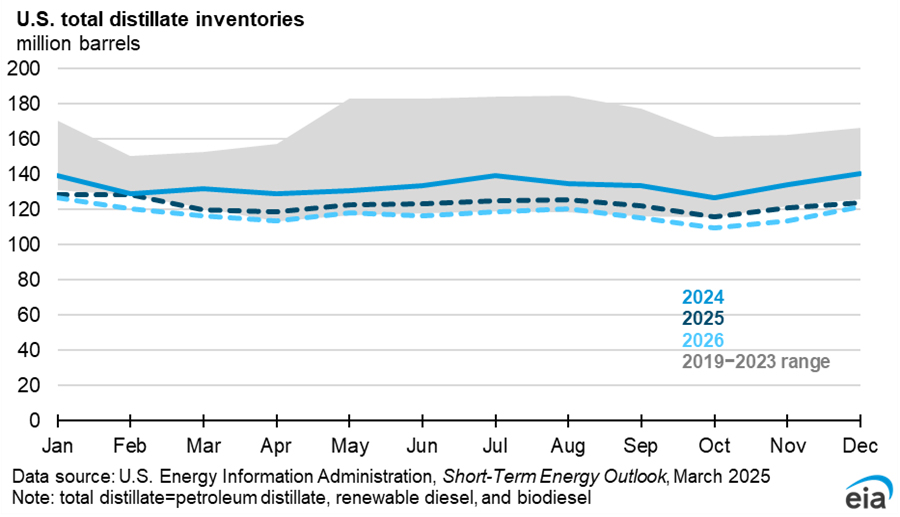

This year, two United States refineries are scheduled to cease operations. The Houston-based LyondellBasell refinery has already initiated its shutdown process, reducing the nation’s refining capacity by 264,000 barrels per day. Additionally, the Los Angeles-based Phillips 66 refinery is set to close, further decreasing domestic refining capacity by 138,000 barrels per day. Collectively, these closures will diminish production capacity by 400,000 barrels per day. Chevron and Valero are also contemplating the shutdown of several California refineries, which is expected to tighten diesel supply.

These closures, coupled with similar actions in Europe, will result in an estimated reduction of 1 million barrels per day in refining capacity across the U.S. and Europe. Guttman Energy, Inc. | 200 Speers Street | Belle Vernon, PA 15012 | T: 724.489.5199 | guttmanenergy.com

The decrease in refining capacity, alongside rising domestic demand for refined products, will lead to a reduction in exports of these products to other countries. As of this publication, there are 127 active refineries in the U.S., with a total operable capacity of 18.4 million barrels per day.

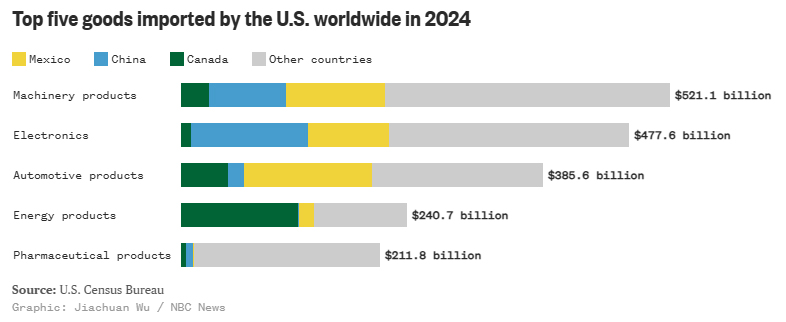

Current (loosely used) Impact of Tariffs

The market landscape has become increasingly complex due to newly imposed tariffs on petroleum imports from Canada and Mexico. Initially postponed at the beginning of February, these tariffs officially took effect on March 12th. Currently, Canadian oil imports are subject to a 10% tariff, while oil imports from Mexico face a 25% tariff. The tariff on Canadian imports may impact refineries in PADD 2 (Midwest), where many rely on Canadian crude oil and have made significant investments in converting facilities to efficiently process the heavy crude from Canada.

Analysts believe that these tariffs would need to remain in place for several years before significantly altering the volume of crude oil imported from Canada. The supply-chain infrastructure of the two countries is highly integrated, and there is no straightforward way for the U.S. to replace the approximately 4 million barrels per day of Canadian oil it imports.

Additionally, questions remain on the application of the tariffs to products that meet the definition of origin under the US, Mexico, Canada Agreement (USMCA). If products meet this definition, then it has been reported that they will be exempt from the announced tariffs. In addition, certain products have been excluded from the tariffs regardless of meeting this requirement.

- Crude Oil, Diesel, and Gasoline Tariffs: Imports from Canada face a 10% tariff, while imports from Mexico face a 25% tariff.

- USMCA Exemptions: Crude oil, diesel, and gasoline that meet USMCA rules of origin are exempt from these tariffs.

- General Tariffs: Most other imports from Canada and Mexico are subject to a 25% tariff, with specific exemptions for energy products and potash.

Heating Degree Days vs. Historical

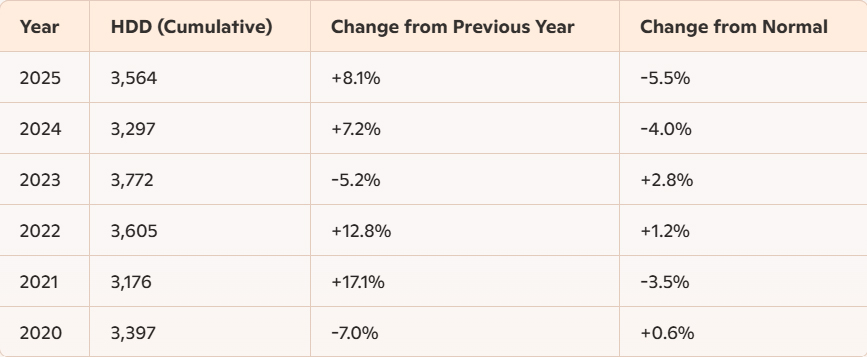

Heating degree days (HDD) are a measure of how much heating is needed to maintain a comfortable indoor temperature. They are calculated by comparing the daily average outdoor temperature to a base temperature, typically 65°F (18°C). The higher the HDD, the colder the weather, and the more heating is required. 2025 has seen an increase in HDD compared to 2024.

The cost of heating fuels can fluctuate based on demand and supply. During colder periods with high HDD values, the increased demand for heating fuels can drive up prices, further increasing energy costs. Understanding historical HDD trends helps companies better prepare for supply and demand challenges, especially during cold weather seasons.

Gasoline Specification Changes on the Colonial and Buckeye Pipelines

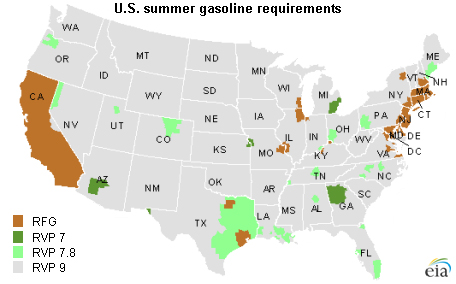

As the temperatures rise and the days grow longer, gas stations across the Northeast begin the annual transition from winter to summer grade gasoline. This change is essential for ensuring optimal vehicle performance and compliance with environmental regulations. Both Colonial and Buckeye pipelines have specific product specifications and quality assurance programs. For instance, Colonial Pipeline adjusts Guttman Energy, Inc. | 200 Speers Street | Belle Vernon, PA 15012 | T: 724.489.5199 | guttmanenergy.com

summer-grade Reid Vapor Pressure (RVP) specifications to meet seasonal requirements. Similarly, Buckeye Partners provides detailed guidelines for product classifications and scheduling. RVP is a measure of gasoline’s volatility, indicating how easily it evaporates.

During the colder months, gasoline is formulated to have a higher RVP. This means it evaporates more easily, which is crucial for starting engines in low temperatures. Winter gasoline blends are cheaper to produce, resulting in lower prices from late September through late April. In contrast, summer grade gasoline has a lower RVP to prevent excessive evaporation. This blend is more expensive to produce due to the stringent requirements aimed at minimizing evaporative emissions. The transition to summer grade gasoline typically begins in early spring. Refineries start producing summer blends in March and April to ensure that they meet the EPA compliance dates.

By May 1, fuel terminals are required to sell only summer gasoline, and gas stations must complete the changeover by June 1st. In the Northeast, this transition is particularly important due to the region’s warm summers. Gas stations gradually switch to summer gasoline, ensuring that drivers have access to fuel that performs well in higher temperatures. The process is phased to allow for the depletion of winter gasoline stocks and the introduction of summer blends.

Sources;

1) NBC News

2) Platts, OPIS, Argus

3) U.S. Energy Information Administration & U.S. Customers and Border Protection 4) Oil Price Information