June Market Update Summary

- One Big Beautiful Bill Act

- Summer Driving Season and Fuel Prices

- Refinery Conversions

- Gasoline Market

One Big Beautiful Bill Act

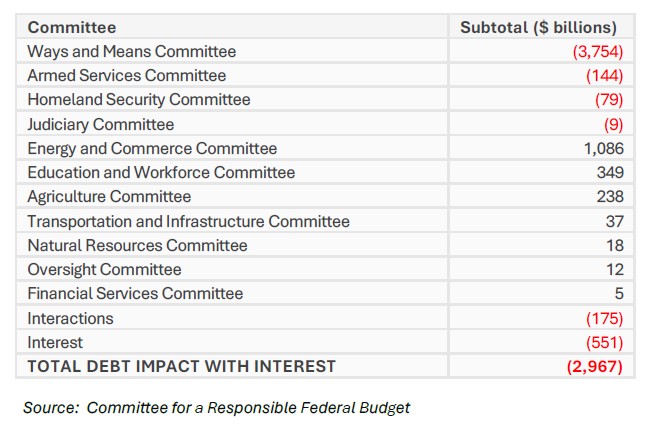

Passed by the House of Representatives on May 22nd, The One Big Beautiful Bill Act is a major piece of tax and federal spending legislation with implications of its tax incentives resonating throughout the entire U.S. Energy Industry.

Although there are many components to the act itself, one point of emphasis we can focus on is the elimination of the 45Y Clean Energy Production Credit and the 48E Clean Electricity Investment Credit and the increased emphasis on the 45Z Tax Credit. The 45Y Clean Energy Production Credit is a tax credit for facilities that generate electricity with net zero greenhouse gas emissions. This credit heavily favors construction of energy projects utilizing solar and wind. The 48E Clean Electricity Investment Credit favors investment in energy storage technology utilized for solar and wind projects. The One Big Beautiful Bill Act ends both credits for all projects that begin construction 60 days after enactment if they start service before the end of 2028. The bill also limits foreign entities from being able to receive the credits. These actions will disincentivize investment in clean energy projects and dissuade solar, battery, and wind projects in the future.

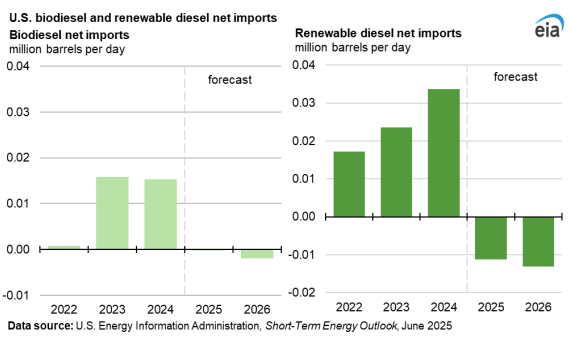

The 45Z Production Credit is a credit for production of low-carbon transportation fuels and is being augmented by the One Big Beautiful Bill Act in a few ways. One way is that it is extending the life of the credit out to 2031, which will incentivize the continued investment in renewable fuel production capacity. Another addition will be the requirement that feedstocks be derived from the U.S., Canada, or Mexico. This will disincentivize renewable fuel produced from feedstocks like Brazilian Sugarcane and incentivize corn-based renewable fuel production.

In short, the One Big Beautiful Bill act will incentivize the continued production of renewable fuels in the U.S, while disincentivizing the production and investment in solar, wind, and battery storage. This should give us a clear direction on the continued demand for renewable fuels in the U.S.

Summer Driving Season and Fuel Prices

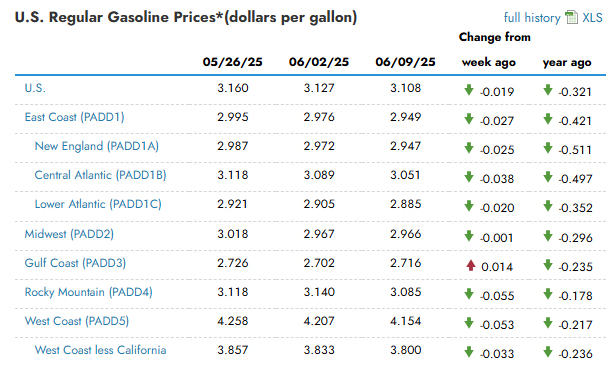

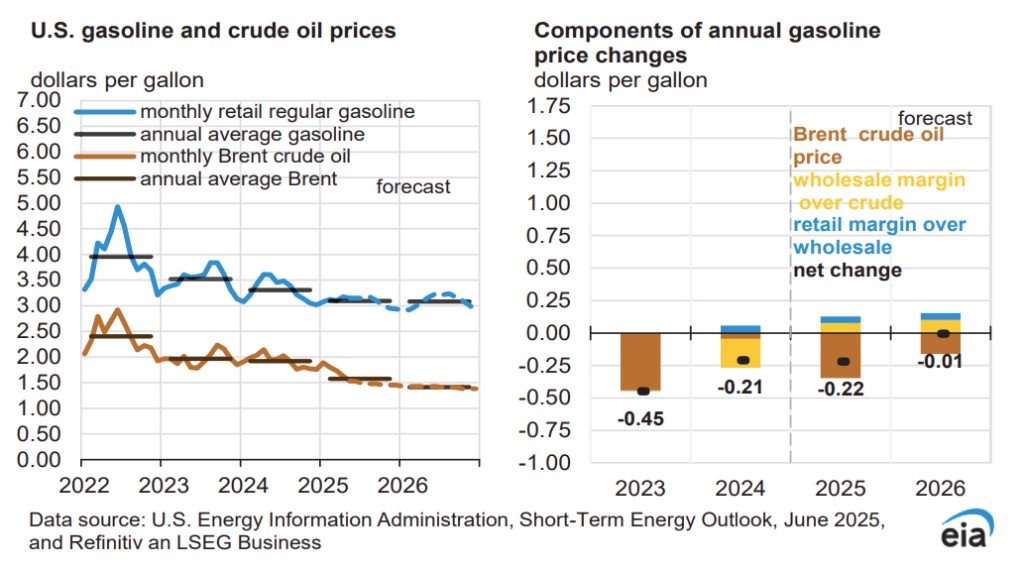

Warm weather leads to vacations, and vacations long trips on the road. Normally, with the transition to summer grade gasoline and increased demand, gasoline prices tend to rise as we move into the summer months. But this year, prices have continued to drop for consumers and may continue to drop in the future.

There are a few different factors that have led to this drop in prices. First and foremost, crude inventories have remained elevated globally. OPEC+ has ramped up production, with Saudi Arabia raising production to 130,000 bpd and UAE by 11,000 bpd in May 2025. With an increase in oil production, a drop in oil prices could lead to increased refined product output, driving down gasoline prices domestically as more barrels enter the market. Increased vehicle efficiency may be another factor in the drop in prices. Recent policies have brought more fuel-efficient vehicles, as well as electric and hybrid vehicles, onto the market, and in the aggregate may be dampening demand across the U.S.

As summer driving season continues across the U.S., consumers and suppliers will continue to have a watchful eye on the market.

Refinery Conversions

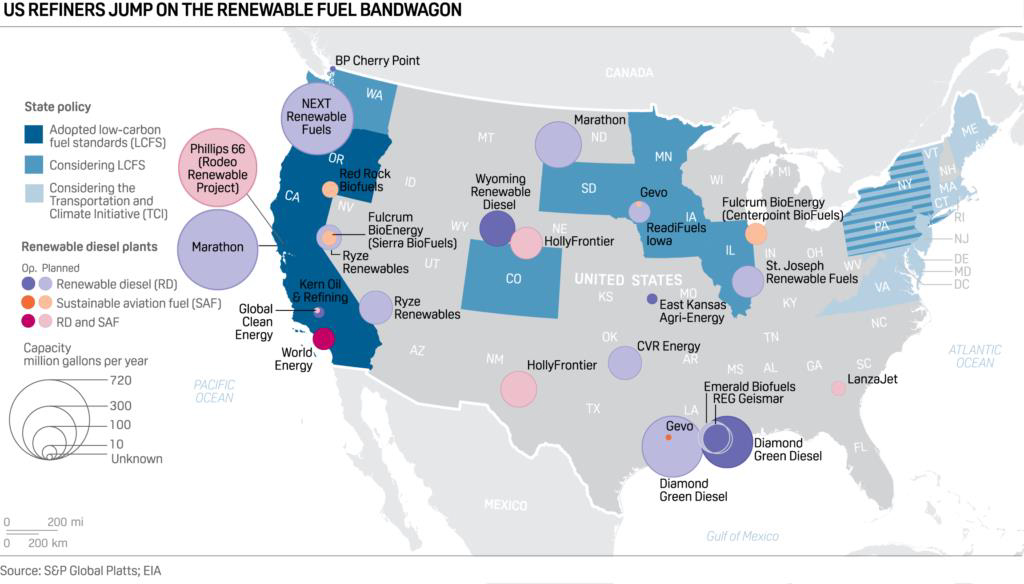

An energy hungry world demands a solution to its energy needs, and one solution many energy companies are looking to the future with are renewable fuels. With the increased presence of renewable fuels, American companies are converting existing refineries and other facilities in operations to manage the production of these exciting new products.

Phillips66 converted their Rodeo, California refinery from processing crude oil to renewable feedstocks in 2024, and now the plant is producing over 30,000 barrels per day of renewable diesel along with sustainable aviation fuel. On another note, Marathon Petroleum converted its Martinex, California refinery into a renewable complex able to produce 730 million gallons per year. If feedstocks such as soybean oil and used cooking oil remain economically viable, we may see increased capacity added to the market in future operational conversions.

Renewables are an exciting space that is growing in prominence across the U.S. As capacity grows, so will the economically viability of renewable products. Based on recent investments, we should expect a positive future outlook in the renewable space.

A Rise in U.S. Gasoline Exports

American crude and refined product exports have held at a high level from 2024 into 2025, reaching a level of 345,061 thousand barrels per day in December 2024 and finishing at a level of 330,859 in March 2025. The U.S. is now the largest exporter of gasoline products worldwide, exporting 26,444 thousand barrels into the global market in 2025. For most of the 20th century, the U.S. imported more gasoline than it exported. What has led to such a change in fortunes for the U.S petroleum industry?

One reason for this change has been the increase in refinery utilization rates over the course of the past 15 years. In 2023, ExxonMobil expanded its Beaumont, Texas refinery from 369,000 barrels per day to 609,000 barrels per day. Marathon also expanded its Galveston Bay refinery to produce 631,000 barrels per day. Large refinery capacity increases such as these increase the amount of refined product that will be brought to market. U.S. Demand has been relatively flat over the past 10 years, leading to a flow of barrels out of the country

U.S. Domestic Production is strong – both from a crude standpoint and refined products standpoint. As the U.S. has moved into becoming a net gasoline exporter since 2016, only time will tell if we continue our dominance into the future.

Sources;

1) Platts, Oil Price Information Service

2) Committee for Responsible Federal Budget

3) Reuters

4) Energy Information Administration (EIA)

5) Renewable Fuels Association (RFA)

6) Carnegie Endowment