July Market Update Summary

- Current Market

- Tariff Update

- Global Conflicts

- U.S. Inventories and Hurricane Season

Current Market Review

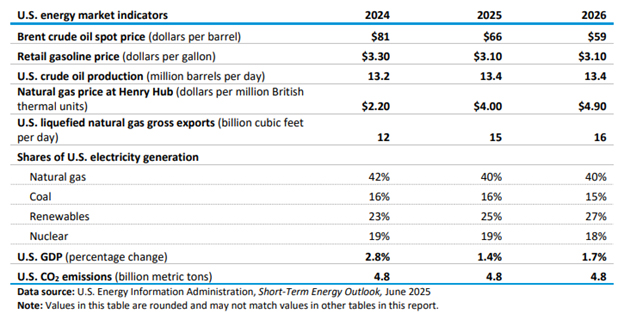

The market, ahead of peak summer supply and demand, is working to find a balance for projected demand. Both gasoline and diesel demand are down – gasoline down 1% year-over-year through June with decreased recreational travel, and diesel falling 115,000 barrels/day in March, with demand expected to fall through the end of 2025, and continue falling into 2026.

Gasoline cracks (the difference between the NYMEX RBOB price and NYMEX WTI Crude Oil) softened post-Memorial Day due to weaker than expected travel volume, and are projected to continue to weaken into late 2026 due to higher inventory levels and lower exports. In contrast, diesel cracks rose in June, especially on the West Coast, citing tight supply and refinery outages as the cause. One of the primary drivers to the rise in diesel cracks was the fear surrounding global diesel inventories.

The price of crude oil is continuing a volatile trend, with a downward price trajectory, which is forecasted to continue into 2026. With crude prices on the decline, retail gasoline prices are expected to fall across the U.S.. Reduce retail prices would be supportive of summer travel, which should positively result in more recreational and discretionary driving. Historically, retail prices have followed the mantra of “rise like a rocket, fall like a feather” – which implies that downward movement in retail prices is delayed compared to how quickly the underlying commodity price retreats.

Tariff Update

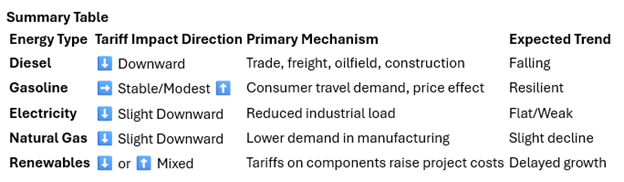

The U.S. is nearing trade agreements as we approach the July 9th deadline, which will introduce higher tariff rates to other countries beginning on August 1st. As we approach implementation, it’s important to understand the impact tariffs have on each product individually.

Tariffs are expected to cause downward pressure on distillate products, which are vulnerable to tariffs due to their direct link to industry activity, freight, construction and agriculture. Anticipated reduction in freight and manufacturing goods will have reduced imports and manufacturing activity, causing a lower diesel demand for trucking and rail. The construction and oilfield segments are impacted as well – where tariffs on steel and aluminum yield an increased product cost, slowing both private construction and oil & gas rig activity.

Gasoline should see less impact through tariffs than distillate, largely because gasoline demand is a factor of end-user consumer demand. We do expect and anticipate some indirect effects, like lower retail prices due to softer crude prices and increased supply. Though we are not seeing an impact to discretionary travel due to tariffs yet, if consumer confidence or employment are negatively impacted, then travel could decline, with gasoline demand declining as a result.

Global Conflict

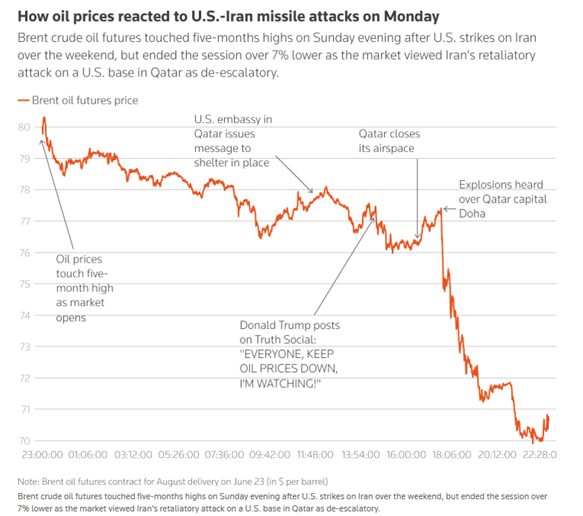

The conflict between Israel and Iran caused sharp impacts to the market. Upon market open after the U.S. strikes on Iran, oil was at a five-month high. With retaliatory strikes and ultimately a de-escalation (still holding), prices settled at a two week low following a ceasefire between Iran and Israel. Summary of the event timelines below;

With U.S. involvement in the conflict, concern arose regarding the Strait of Hormuz – a major water thruway between Iran and Oman responsible for almost a fifth of global crude consumption. In addition to crude, a significant amount of European distillate products move through the Strait of Hormuz, which increase concern around inventories ahead of winter demand. Though concerns around the Strait of Hormuz, Iran declined blocking of the Strait, which has prevented impact to the global oil supply.

U.S. Inventories

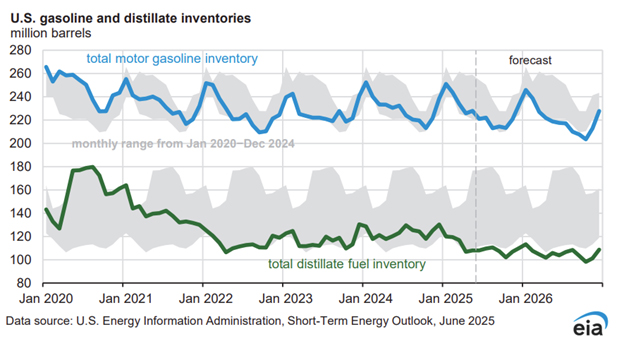

Gasoline inventories in the U.S. remain tight, with upcoming refinery closures at the forefront, especially in PADD 5. With its refinery closures, gasoline inventories on the West Coast are expected to be down 11%. With the decline in refinery production, West Coast retail gasoline prices are expected to increase upwards of 15 cents per gallon. Comparatively, East and Gulf Coast regions are expected to see declines of 3 and 8 cents per gallon respectively. Though not in the clear – Nigeria’s Dangote refinery moves forward with planned maintenance, and downtime could divert gasoline demand towards our East Coast, tightening supply.

Distillate inventories remain tight as well through PADDs 1 and 2, but are building in PADD 3. Where distillate inventories are tight, we are relying more heavily on imports. With the potential for Dangote’s production being delayed, this could cause even tighter inventories into the fall for the East Coast.

In addition to our already tight inventories, we are approaching hurricane season. NOAA is forecasting a less-intense season than last, but this may cause refinery disruptions resulting in tighter inventories. With the Gulf Coast accounting for 55% of our total U.S. refining capacity, the risk of refinery downtime poses a huge impact to our global inventories, with up to 1 million barrels per day offline due to outages.

- Platts, Oil Price Information Service

- Reuters

- Energy Information Administration (EIA)

- NPR