January Market Update

- Retail Gasoline Prices

- 2025 Petroleum Market Recap

- Early 2026 Market Action

- Venezuela and Oil Exports

- OPEC+ Production Targets

- 2026 Retail Forecast

Retail Gasoline Prices Decline for Third Consecutive Year In 2025

- Drop driven by lower crude prices and oversupply concern

- Likely to continue to lower averages in 2026

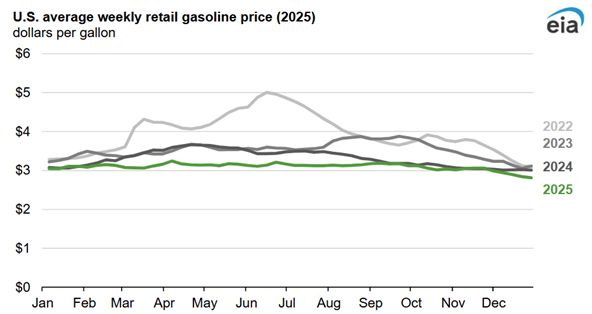

U.S. retail gasoline prices averaged $3.10 per gallon in 2025, down $0.21 from 2024, marking the third straight year of declines. The drop was primarily driven by lower crude oil prices caused by oversupply concerns and a weaker global economy early in the year. Prices peaked at $3.24 per gallon in April, before the summer driving season, and fell to an annual low of $2.81 per gallon in late December.

Consumption decreased slightly (less than 1%) compared to 2024, while inventories remained stable due to modest export growth. Memorial Day prices were the lowest since 2020 (inflation-adjusted), but refining sector tightness pushed prices near 2024 levels in September through November. Regional averages varied widely, from $2.39 per gallon on the Gulf Coast to $4.32 per gallon on the West Coast.

2025 Petroleum Market Recap

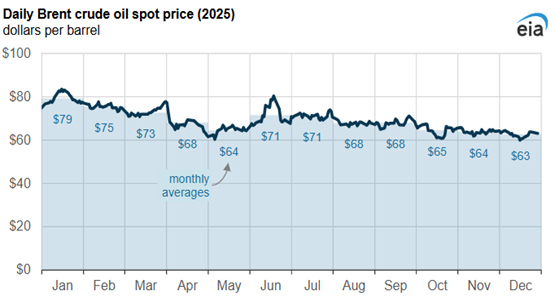

- Global supply outpaced demand throughout 2025, driving crude oil inventories to build by more than 2.5 million barrels per day in the second half—stock builds not seen since 2000 (except 2020).

- Geopolitical and sanction pressures reshaped trade flows, including stronger enforcement on Russia, Iran, and Venezuela-related shipping

The 2025 petroleum market faced price declines, driven by global oversupply and weak demand. OPEC+ rolled back production cuts, increasing supply in the market, while geopolitical tensions—sanctions on Russia and Iran, U.S. blockades on Venezuelan oil, and Middle East flare-ups—caused brief volatility. Despite these shocks, Brent crude fell about 18% for the year, marking its sharpest drop since 2020.

2026 Early Market Action

- Oil prices remain subdued despite geopolitical turbulence, as structural oversupply from U.S., Brazil, and other non-OPEC producers continues to influence market dynamics

- Heightened enforcement and political developments—from U.S. tanker sanctions to Maduro’s capture—inject uncertainty into global trade flows

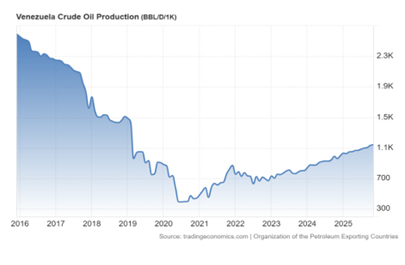

2026 petroleum market is beginning the year under a mix of heavy supply and elevated geopolitical risk. Global oil production remains robust, keeping Brent crude near the $60 per barrel level, but volatility has increased sharply as geopolitical tensions intensify. The U.S. capture of Venezuelan leader Nicolás Maduro has injected uncertainty into future Venezuelan oil flows, raising questions about sanctions,governance, and the potential reentry of one of the world’s largest crude reserves into global markets. At the same time, aggressive U.S. enforcement actions against sanctioned tankers—particularly those linked to Russia and Iran—have added risk.

Despite these geopolitical flashpoints, structural oversupply remains the dominant force in the market. Rising production from the United States, Brazil, and other non-OPEC producers has largely absorbed disruptions and limited sustained price rallies. President Donald Trump is scheduled to meet with executives from major oil companies in the near term, signaling potential policy shifts around domestic production, regulation, and energy strategy that could influence long-term supply expectations.

Washington Wasting No Time to Start Negotiating Exports

- Talks are underway to export Venezuelan crude to U.S. refiners, easing PDVSA’s storage crisis and potentially diverting shipments from China.

- Discussions include auctions, U.S. licenses for PDVSA partners, and even using Venezuelan crude to refill the U.S. Strategic Petroleum Reserve.

U.S. and Venezuelan officials are in talks to export Venezuelan crude to U.S. refiners, potentially diverting supplies from China and easing storage constraints for PDVSA (state-owned oil and gas company of Venezuela). The negotiations follow a U.S. blockade on Venezuelan oil exports and the recent capture of President Nicolás Maduro, which forced PDVSA to cut production due to lack of storage.

OPEC+ Agrees to Maintain Current Production Through Q1

- OPEC+ Agrees to pause increases in production increments

- Next meeting is February 1st

In January 2026, eight key OPEC+ members reaffirmed their commitment to market stability by maintaining current production levels through the first quarter. This decision underscores the group’s confidence in a resilient global economic outlook and robust oil market fundamentals. By opting for continuity rather than immediate adjustments, OPEC+ signals a strategic preference for predictability amid lingering geopolitical uncertainties and evolving macroeconomic conditions. The alliance also emphasized its readiness to recalibrate output if market dynamics shift, reflecting a cautious yet coordinated approach aimed at balancing price stability with flexibility. This stance highlights OPEC+’s role as a stabilizing force in energy markets, prioritizing long-term equilibrium over short-term volatility.

GasBuddy 2026 Forecast Outlook

- GasBuddy forecasts $2.97 per gallon national average and about $2,080 in gasoline spending

- Diesel forecasted to fall to national average of $3.55 down from $3.62 in 2025

Fuel prices across the region in 2026 are expected to follow a pronounced seasonal pattern. In Pennsylvania, prices are forecasted to average between $3.08 and $3.37 per gallon, while Ohio is projected to remain lower, ranging from approximately $2.80 to $3.06. Prices are expected to climb through early spring, with higher averages in April and a peak in May, before gradually easing through the summer.

By August, fuel costs are anticipated to lower near $3.00 per gallon, dip below $3.00 in September, and continue declining toward year-end, with prices forecasted around $2.85 in November and approximately $2.83 in December to close out the year.

Sources:

- Platts, Oil Price Information Service

- Energy Information Administration (EIA)

- International Energy Agency (IEA)

- GasBuddy

- S&P Global

- Microsoft 365 Copilot