Market Update – 2024 Review Summary

• 2024 Market Overview

• Geopolitical risk

• Refinery Operations

• OPEC Production

2024 Market Overview

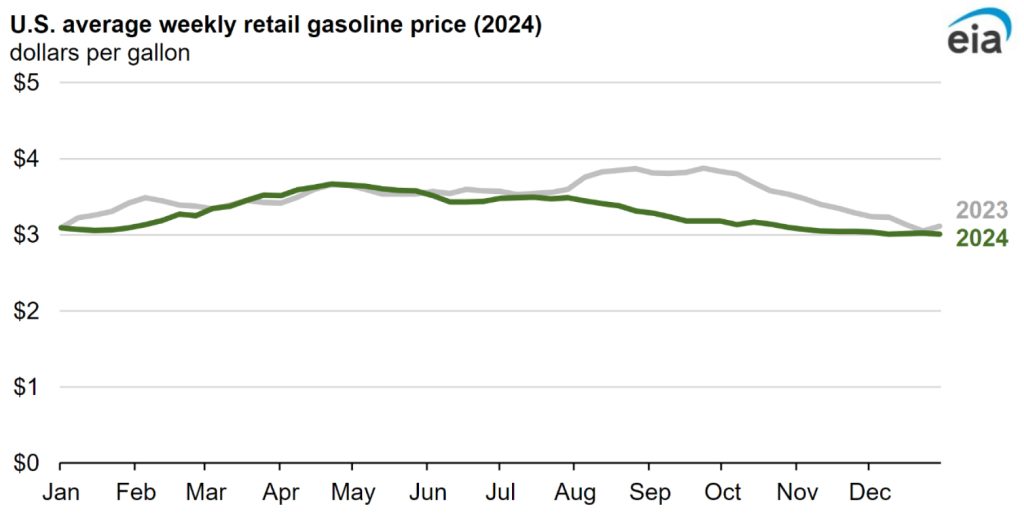

In 2024, U.S. retail gasoline prices averaged about 20 cents less than in 2023.

The U.S. retail price for regular grade gasoline averaged $3.30 per gallon (gal) in 2024, $0.21/gal less than in 2023. Lower crude oil prices and narrower refinery margins in 2024 than in 2023 both contributed to the decrease in U.S. retail gasoline prices, according to data from our Gasoline and Diesel Fuel Update. From the first week of 2024 through the last week, national average weekly gasoline prices decreased $0.08/gal.

In December 2024, the unleaded market showed some notable trends:

The retail gasoline price was highest in 2024 during late April when it reached $3.67/gal, below last year’s high price of $3.88/gal in September 2023. The high preceded the summer driving season, when gasoline use peaks in the United States, and which often sets the highest prices of the year. However, peak prices before the summer season this year reflected relatively lower prices for gasoline and other petroleum products throughout the second half of 2024. Retail gasoline prices decreased to an annual low of $3.01/gal in early December and remained at a similar level throughout the rest of 2024. The price range in 2024 was narrower than in 2023, reflecting relatively flat crude oil prices.

U.S. gasoline retail prices decreased for the second consecutive year in 2024. Gasoline prices and prices for crude oil and other petroleum products had increased sharply in 2022, when U.S. gasoline prices were at their highest since 2014, after adjusting for inflation.

Prices: The average retail price for regular unleaded gasoline in the U.S. was around $3.05 per gallon. This represented a decrease in earlier months, influenced by lower crude oil prices and narrower refinery margins.

Consumption: Gasoline consumption remained relatively low, with motor gasoline supplied in November 2024 totaling 8.8 million barrels per day. This was partly due to ongoing economic factors and changes in consumer behavior.

Inventories: Gasoline inventories were stable, with levels consistent with historical trends.

Market Impact: The lower prices provided some relief to consumers, while the stable inventories indicated a balanced supply and demand situation. These indicators suggest a period of lower gasoline prices and consumption, influenced by broader economic factors and market conditions.

Data source: U.S. Energy Information Administration

In December 2024, the diesel market showed some notable trends:

In 2024, the average price of diesel in the U.S. saw a slight decrease compared to 2023. By December 2024, the average price per gallon was $3.49, which was the lowest price in the past 24 months. This decrease was primarily due to lower crude oil prices

In comparison, diesel prices in 2023 were generally higher, influenced by various factors including supply chain disruptions and higher crude oil prices

Price: The national average price for on-highway diesel was around $3.52 per gallon in November 2024, continuing a downward trend from the previous months 12.

Consumption: Distillate fuel consumption, which includes diesel, remained weak compared to historical trends. This was partly due to a slight decline in U.S. manufacturing activity.

Inventories: Inventories for distillate fuel were stable, with 31.5 days of cover at the end of November, slightly above the six-year average.

Market Impact: The lower diesel prices provided some relief to carriers, especially in a soft market where they often need to deadhead longer distances to find loads.

Data source: U.S. Energy Information Administration

OPEC Production

In December 2024, OPEC held its 189th Meeting on December 10th. Key updates from the meeting include:

Leadership Changes: HE Eng. Mohsen Paknejad, Minister of Petroleum of Iran, was elected as President of the OPEC Conference for 2025. HE Hayan

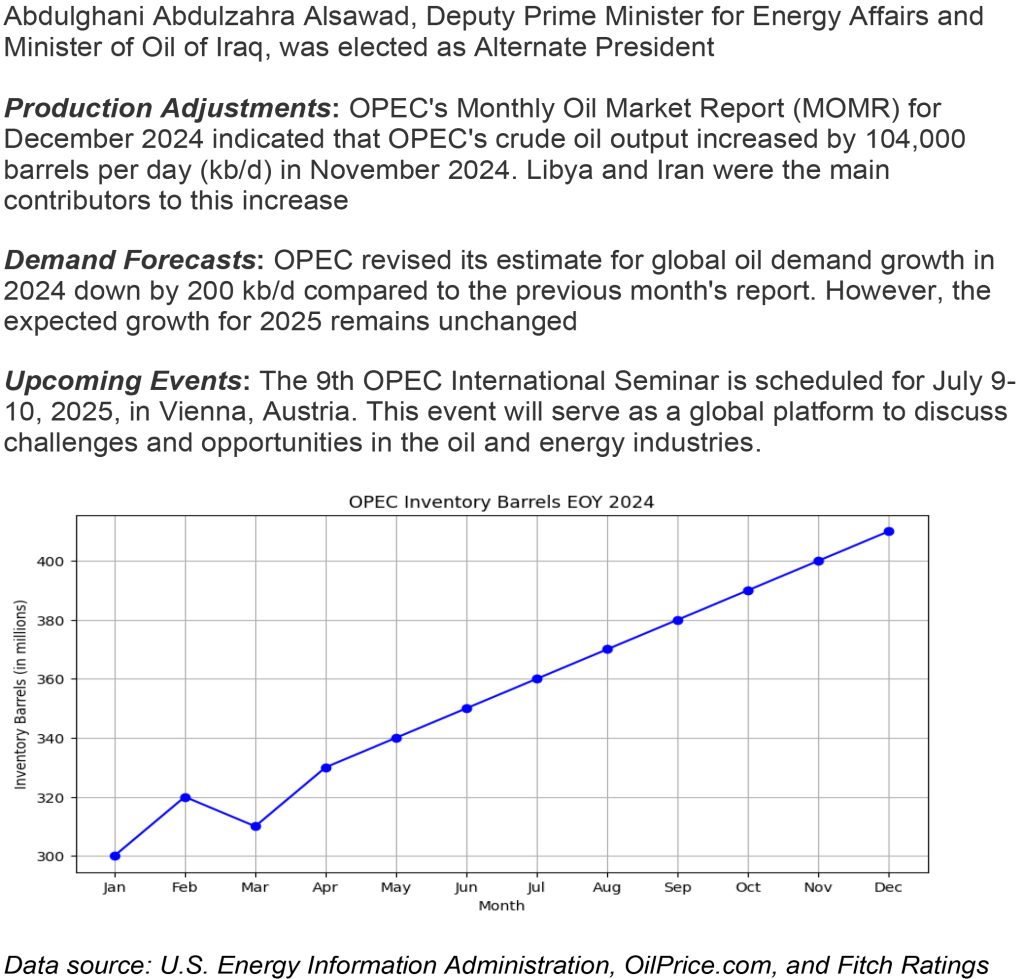

Abdulghani Abdulzahra Alsawad, Deputy Prime Minister for Energy Affairs and Minister of Oil of Iraq, was elected as Alternate President

Production Adjustments: OPEC’s Monthly Oil Market Report (MOMR) for December 2024 indicated that OPEC’s crude oil output increased by 104,000 barrels per day (kb/d) in November 2024. Libya and Iran were the main contributors to this increase

Demand Forecasts: OPEC revised its estimate for global oil demand growth in 2024 down by 200 kb/d compared to the previous month’s report. However, the expected growth for 2025 remains unchanged

Upcoming Events: The 9th OPEC International Seminar is scheduled for July 9-10, 2025, in Vienna, Austria. This event will serve as a global platform to discuss challenges and opportunities in the oil and energy industries.

Geopolitical risk

In December 2024, several geopolitical risks impacted on the petroleum industry:

Middle East Tensions: Military escalations in the Middle East, particularly involving Iran, increased volatility in the global oil market. These tensions disrupted supply chains and contributed to price fluctuations.

Sanctions on Russia: New sanctions from the G7 on Russia’s “shadow fleet” added a risk premium to oil prices. These sanctions targeted entities involved in facilitating Russia’s oil trade, further tightening the market.

Iran Nuclear Oversight: Iran agreed to more stringent monitoring by the International Atomic Energy Agency (IAEA) at its Fordow site. This development eased some tensions but kept the region under close watch.

OPEC+ Production Adjustments: OPEC+ delayed oil production increases until April 2025 and extended the complete reversal of cuts until the end of 2026. This decision was aimed at managing supply amidst geopolitical uncertainties.

Data source: U.S. Energy Information Administration, OilPrice.com, and Fitch Ratings

Refinery Operations

In December 2024, global refinery throughputs reached an annual peak of 84.3 million barrels per day (mb/d), which was nearly 3 mb/d more than in October 2024 when maintenance and economic run cuts constrained activity

This increase was driven by higher demand for refined products and improved margins in some regions. Crude runs averaged 82.7 mb/d for the entire year of 2024, reflecting a steady increase in refining activity compared to previous years

Data source: U.S. Energy Information Administration, OilPrice.com, and Fitch Ratings