February Market Update Summary

• Tariffs, Feedstock Alternative, and Canadian Crude

• OPEC Update

• Presidential Priorities, Ethanol, and RVP

Tariffs, Substitution, and Canadian Crude

The new presidential administration is shaking up the normal routine for oil refiners in the Midwest, as President Trump plans to institute tariffs on Canadian crude coming into the nation. These tariffs are suggested to be between 10% and 25% on all crude imported from our neighbor to the north. In anticipation of these tariffs, Trump has boasted of ramping up U.S. oil production to make up for the shortfall. Refiners in the Midwest and around the nation do not agree.

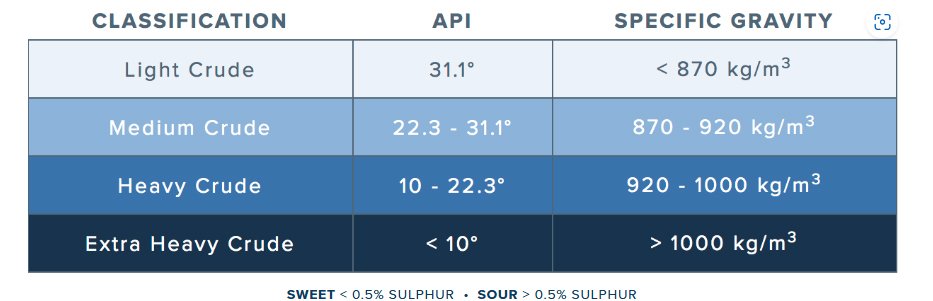

This disagreement can be boiled down to two simple facts: Canadian crude oil tends to have a lower API gravity than crude oil produced in the United States, and the Midwest and Gulf Coast have a number of complex refineries specifically tuned to heavier feedstocks. These complex refineries are generally better attuned to converting a lower API crude into a broader range of end products through secondary conversion, and this allows them to have improved profitability on the discounted feedstocks used.

Putting tariffs on Canadian crude will affect the profitability on outputs generated by complex refineries and limit their responsiveness in the face of this market change, due in part to the limited availability of alternative crude sources. Similar heavy crudes to

the ones produced in Canada, such as Venezuelan crude, will be limited to import due to sanctions and transportation costs. In the face of potential tariffs and this lack of flexibility from a feedstock standpoint, American refiners will have to wait and see how the situation plays out.

OPEC Update

OPEC production cuts have continued to hold as we have moved into 2025, but changes are beginning to take place as we move toward the second quarter of 2025. OPEC+ announced in December that production cuts would be rolled back starting in April 2025, with the United Arab Emirates raising production by 300,000 bpd gradually throughout the year.

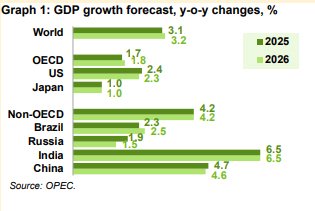

In their January 2025 report, OPEC maintained a bullish outlook on both the state of the global oil market as well as the global forecast going into 2026. OPEC continues to foresee a growth in global oil demand of 1.4 million barrels a day in 2025, with most of this oil demand being reflected in non-OECD countries. OPEC also foresees most of the continued growth in world oil supply to be concentrated in non-OPEC countries like the United States.

President Trump, Ethanol, and RVP

Amidst a slew of executive orders coming from the White House on January 20th, President Trump included a provision potentially allowing waivers on the year-round sale of E15 gasoline nationally “to meet any potential shortfalls of gasoline across the nation”. Gasoline shortages may be an extreme in what is experienced in the day-to-day in the United States, but why is E15 (or Unleaded 88) seasonal to begin with? It all comes down to the science around Reid Vapor Pressure.

The answer to this question boils down to Reid Vapor Pressure, or RVP. The Environmental Protection Agency has issued guidelines for federal air quality attainment since the Clean Air Act of the 1970s, and part of this act involves the regulation of ozone in regions throughout the United Sates. A key component of regulating ozone is managing pounds per square inch of Reid Vapor Pressure for gasoline.

The recognized limit for gasoline in the summer months is an RVP of 9.0 psi, but blending gasoline with ethanol effectively adds an additional 1.0 psi to the fuel produced. This has normally been avoided by issuance of a “one pound-waiver” on gasoline produced nationally, topping out the upper the limit to roughly 10.0 psi in attainment regions. Blending an additional 5% ethanol in each gallon of gasoline would thus seem to imperil the EPA’s guidelines during the summer months, but evidence on its true impact is inconclusive. In the meantime, we will have to wait and see how this administration’s legislative handiwork affects what consumers see at the pump.

Changes to the RVP schedule

Scheduling for changing product grades is a normal part of the transition from winter to summer products in the gasoline market. Winter grade products, with an RVP equivalent to 15.0 psi, are typically shipped from November through March. At this point, shippers transition to a midgrade product through March and April, until the beginning of the transition to summer grade product in May, when all summer grade product is shipped with an RVP specification of 9.0 psi.

However, unforeseen changes to the RVP calendar for some U.S. pipelines has led to a reevaluation of shipping schedules for pipeline shippers. Buckeye Partners has updated their eastern products schedule to transition from winter grade to midgrade product one week earlier than usual, starting in the last week of February instead of the first week of March. The transition to summer grade product will also occur one week earlier, with the full transition to a 9.0 psi RVP product taking place in the last week of March instead of the first week of April. While changes like this can be challenging, expertise and careful inventory management can make the transition smoother.

Sources;

1) Federal Register: Declaring a National Energy Emergency

2) Differentials Explained: Why Alberta crude sells at a deep discount | Oil Sands Magazine

3) Organization of the Petroleum Exporting Countries, OPEC Monthly Oil Report