December Market Update

- U.S. Seized Sanctioned Venezuelan Tanker

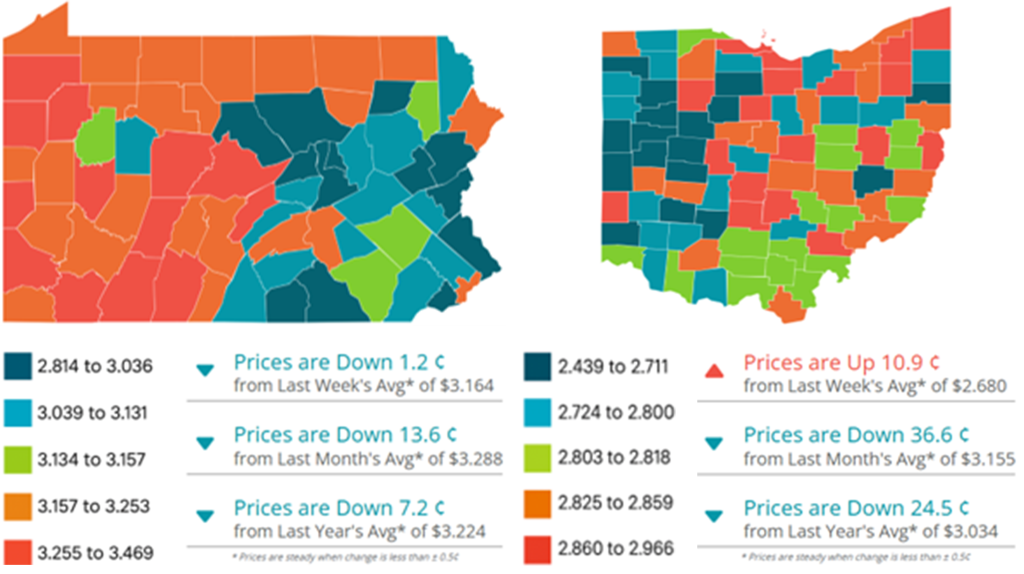

- PA and OH Retail Prices

- 2025 Year-End Travel

- Continuing Federal Rate Cut

- Cold Weather Consumes NE U.S.

- Updated EIA STEO

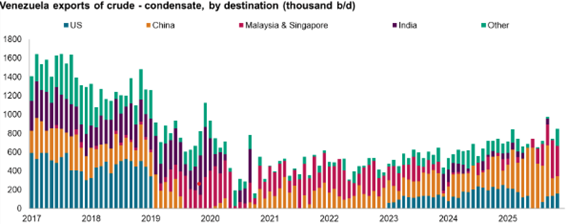

U.S. Seized Sanctioned Venezuelan Tanker

- U.S. action taken under sanctions enforcement

- Minimal direct supply impact but signals tougher action on shadow fleets

- Could raise costs and risk premiums for sanctioned oil flows globally

The U.S. recently seized a Venezuelan oil tanker suspected of smuggling sanctioned crude, marking a significant escalation in enforcement against shadow fleets. This move disrupts Venezuela’s ability to export oil and signals that the Administration is willing to take direct action beyond financial sanctions, raising the stakes for vessels operating without proper registry.

Direct supply impact is minimal given Venezuela’s relatively small output, but the broader implications are significant. Heightened sanction enforcement risk may discourage future shadow fleet movements, adding uncertainty to sanctioned oil flows.

Evidence of this is already emerging: a tanker carrying Russian naphtha for Venezuela’s state oil company PDVSA, along with at least four supertankers scheduled to load crude in Venezuela, reversed course after the U.S. seized a vessel carrying Venezuelan crude, according to ship-tracking data on Monday.

Short-term price volatility may rise slightly as traders’ factor in higher geopolitical risk and potential supply disruptions, creating modest upward pressure on oil futures.

2025 Year-End Holiday Travel Expected to Make History

- AAA projects a record 122.4 million Americans will travel during the year-end holidays, up 2.2% from last year, with 109.5 million traveling by car.

- Lower gas prices—now below $3 per gallon for the first time in four years, fueling increased road travel and higher overall gasoline demand.

AAA projects 122.4 million Americans will travel at least 50 miles from home during the year-end holiday period from December 20 to January 1, 2026, a 2.2% increase over last year and a new record. Of those, 109.5 million will travel by car, up 2% from last year. This increase in road travel comes as national gas prices have fallen below $3 per gallon for the first time in four years, compared to $3.04 at the end of 2024, and prices may continue to decline as 2025 closes. The combination of lower fuel costs and higher travel volume means overall gasoline demand will rise, even though individual travelers will spend less per gallon. Other notable increases include a projected 2.3% rise in air travel and a 6% increase in other modes of transportation.

Continuing Federal Rate Cut to End 2025

- Third cut this year: Fed funds now at 3.50–3.75%.

- Slight tailwind for commodities; oil impact capped by supply.

- Near-term: volatility is likely as rate path repricing continues.

The Fed delivered its third 25 basis point rate cut of 2025, bringing the target range to 3.50–3.75%. The move reflects a shift toward easing as growth slows, but the tone remains cautious—signaling that policy is still data-dependent and not a full pivot.

For financial markets, the rate cut provides incremental support to risk assets and commodities through a weaker U.S. dollar, improved liquidity, and looser credit conditions, which can enhance investor appetite for equities and emerging markets. However, crude oil’s upside response is expected to remain limited, as robust supply fundamentals—driven by strong U.S. production and OPEC+ output discipline—continue to cap price gains.

In the near term, expect heightened volatility as traders recalibrate interest rate expectations, reassess global growth trajectories, and weigh the implications for energy demand amid mixed macro signals.

Record-Setting Cold Weather Consumes U.S. Northeast

- Persistent Arctic air intrusions have driven colder-than-average conditions across the Northeastern U.S., with daytime highs in the 20s–30s °F and wind chills often below zero.

- Forecasts indicate continued below-normal temperatures into early 2026, signaling elevated heating demand and potential energy market volatility.

Throughout December, the Northeastern U.S. has experienced colder-than-average conditions, with daytime highs generally in the 20s–30s °F (-6 to 1 °C) and overnight lows often in the teens °F (-10 °C), especially inland and in higher elevations. Several Arctic air intrusions have driven wind chills below zero in parts of New England, reinforcing a strong winter pattern.

Looking ahead, forecasts suggest continued below-normal temperatures into early 2026, driven by persistent polar air outbreaks and an active storm track. While occasional mild spells may

occur, the overall trend points to a colder-than-average winter season, with elevated heating demand and potential energy market impacts.

Persistent cold into early 2026 will keep heating oil demand high, especially in the Northeast. Inventories are near a 40-year low at about 26 million barrels, down 17% year-over-year, while consumption is 9% above last winter. This tight supply-demand balance is likely to keep prices elevated and could trigger regional shortages if polar outbreaks continue.

EIA STEO – December 9

Global Oil Inventories – Inventories are expected to rise through 2026, pushing Brent crude down to about $55 per barrel and keeping prices near that level, with OPEC+, China limiting further decline.

US Gasoline – U.S. gasoline prices are forecast to average lower in 2026 as rising inventories and steady refinery output put downward pressure on retail prices, though seasonal demand spikes and refinery maintenance could cause short-term volatility.

US Diesel – U.S. diesel prices are projected to trend lower in 2026 as inventories build and refining capacity remains strong, though seasonal heating demand and freight activity could create short-term price fluctuations.

Sources:

- Platts, Oil Price Information Service

- Energy Information Administration (EIA)

- GasBuddy

- OilPrice.com

- S&P Global