The energy complex is trading mildly lower as comments by Russia seem to make the bulls weary despite a strong two-day rally by global equity markets.

Read MoreRussian Rhetoric Puts Bulls On Edge

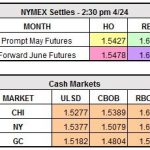

The energy complex is trading mildly lower as comments by Russia seem to make the bulls weary despite a strong two-day rally by global equity markets.

Read More

We are trading decisively lower the day after the May WTI contract expired yesterday as the bulls are slashing their positions. The June contract was trading higher than May yesterday, but it wanted to close the gap today and then some. At first, it was gravitating toward the psychological $50 level, but now we’re under […]

Read MoreOn Wednesday, March 22nd Guttman Energy hosted its 2017 Energy Forum in Canonsburg, PA, the energy epicenter of Pennsylvania. We’d like to thank our customers and business partners who attended. For those of you who weren’t able to attend, following are highlights of the presentations delivered by our guest speakers.

Read MoreSeveral years ago when Guttman Energy undertook the effort of updating our website, we spent a considerable amount of time evaluating what makes our company different from our competitors. We wanted our website to clearly reflect those differences so that our customers and prospects could see that there is more to a relationship with a […]

Read MoreWe have one more day to go before the OPEC/non-OPEC meeting tomorrow in Vienna, Austria. Initial reports and whispers still have not reached a consensus regarding if there will be an agreement by non-OPEC producers to cut 600,00bpd. OPEC’s secretary general says this non-OPEC cut is an absolute requirement in order for OPEC to cut […]

Read More

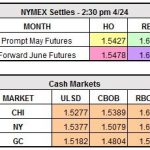

Late yesterday afternoon, Colonial Pipeline’s gasoline pipeline (Line 1) in Shelby County, Alabama, experienced an explosion and fire when a track hoe hit the line, resulting in the closure of the largest fuel pipeline in the U.S. Reports indicated that five individuals were transported to Birmingham-area hospitals for treatment, and there was one fatality recorded […]

Read More

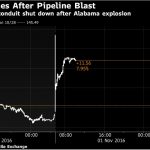

After a week littered with Central Bank headlines across the globe, monetary policy will take a back seat next week to the informal OPEC meeting in Algiers September 26th – September 28th and the first U.S. presidential debate between Hillary Clinton and Donald Trump on Monday.

Read More

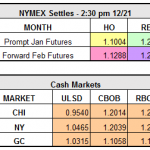

Yesterday saw further declines in the refined products in the front months. January RBOB futures settled down 6.52 cents and the January HO contracts settled down 67 points. Yesterday was also the last trading day for Jan WTI contracts. Trading was therefore very light in the Jan contract, but the Feb contract settled at $35.81 […]

Read MoreThe EIA’s Weekly Petroleum Status Report was released yesterday. There was a build of 2.6 million bbls on crude inventories, mostly located in PADD 5. The Midwest crude builds are due to the BP Whiting refinery issues. The EIA stated that for refined products, gasoline drew 2.7 million bbls and distillate rose by 0.59 million […]

Read More