August Market Update Summary

- Current Market Outlook

- OPEC+ and Russia

- Inventory Builds; Increased Distillate Demand

- North American Refinery Operations

Current Market Outlook

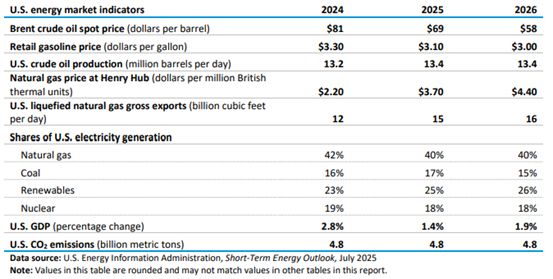

The global petroleum market is facing a delicate balance between geopolitical tensions and supply dynamics. According to the U.S. Energy Information Administration’s latest Short-Term Energy Outlook, Brent crude oil prices are forecast to average $69 per barrel in 2025, a modest increase driven by heightened geopolitical risks—particularly surrounding Iran’s nuclear program. However, this upward pressure is expected to be short-lived. As global inventories build, prices are projected to ease to $58 per barrel by 2026, signaling a return to more stable market conditions.

In the U.S., crude oil production is beginning to respond to these price signals. After reaching a record high of 13.4 million barrels per day in Q2 2025, production is expected to decline slightly, dipping below 13.3 million b/d by late 2026. This reflects a slowdown in drilling and completion activity as producers adjust to softer price expectations.

Meanwhile, trade policy is reshaping the ethane market. The recent lifting of export restrictions to China opened the door for increased U.S. ethane exports, forecasted to reach 650,000 b/d by 2026. This marks a significant reversal from earlier projections and underscores the growing importance of petrochemical demand in global energy trade.

Natural gas markets are also shifting. Higher-than-expected storage levels have led to a downward revision in price forecasts, with the Henry Hub spot price now expected to average $3.40/MMBtu in Q3 2025. Still, prices are projected to rise in 2026 as production tightens and LNG exports expand. Together, these trends highlight a petroleum marketplace in transition—where short-term volatility is giving way to longer-term recalibration across oil, gas, and petrochemical sectors.

OPEC+ and Russia

Oil prices continued to slide as we begin August, with Brent and West Texas Intermediate crude both falling for a fourth consecutive session. The decline was largely driven by OPEC+’s announcement to increase production by 547,000 barrels per day starting in September, effectively ending its latest round of output cuts ahead of schedule. This move has raised concerns about oversupply in an already fragile market.

At the same time, global demand outlooks remain uncertain. JPMorgan has warned of elevated recession risks in the U.S., while China’s recent Politburo meeting signaled a shift away from stimulus toward long-term structural reforms. These developments have dampened expectations for a strong recovery in oil consumption during the second half of the year.

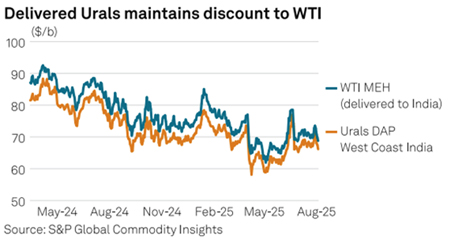

Geopolitical tensions added further complexity, with President Trump renewing threats of higher tariffs on Indian goods due to India’s continued imports of Russian crude. India, now the largest buyer of seaborne Russian oil, dismissed the threats as unjustified and reaffirmed its commitment to protecting its economic interests.

The US will raise tariffs on India’s exports to the US by an additional 25%, according to an executive order released by the White House Aug. 6, as US President Donald Trump continues to pressure India to halt its purchases of Russian oil. The oil market is facing downward pressure from both rising supply and weakening demand signals. Prices are expected to remain volatile.

Inventory Builds; Increased Distillate Demand

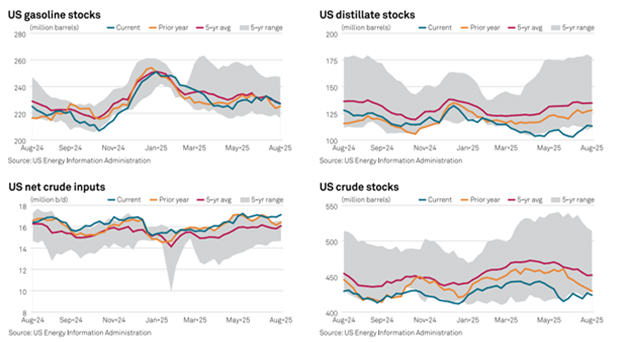

As the U.S. prepares for cooler weather in late 2025, crude oil inventories are beginning to show signs of seasonal rebuilding. Commercial crude stocks rose by 7.7 million barrels in the final week of July, bringing total inventories to 426.7 million barrels, the largest weekly increase since January. Although refinery utilization remains elevated at around 95.4%, slightly reduced domestic demand has allowed for a modest accumulation of supply. The inventory gap compared to the five-year seasonal average has narrowed from 9% to 6%, suggesting that stockpiles are gradually recovering in anticipation of increased energy needs later in the year.

Distillate inventories, which include diesel and heating oil, are also starting to build, though they remain below historical norms. By the end of July, total U.S. distillate stocks reached 113.5 million barrels, still roughly 10% below the five-year average and down from 126.8 million barrels a year ago. The East Coast, especially New England and the Central Atlantic, continues to show particularly low levels, with New England holding just 3.3 million barrels. National distillate demand is expected to rise from 3.80 million barrels per day in 2024 to 3.96 million barrels per day in 2025, driven by industrial activity and seasonal heating needs.

Refineries are ramping up distillate production in anticipation of colder months, with output averaging over 5 million barrels per day in recent weeks. Imports have increased, and exports remain elevated, suggesting a balance between domestic needs and international demand. Despite these efforts, the days of supply for distillates have dropped to 32.3 days, down from 34.7 days a year ago, underscoring the importance of continued inventory building to meet expected winter demand.

North American Refinery Operations

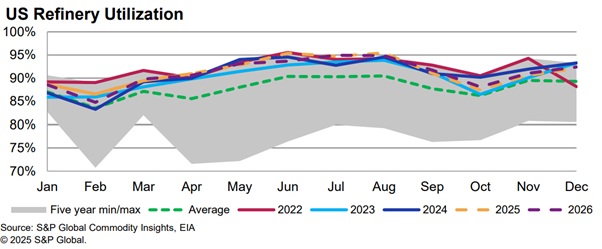

As summer unfolds, North American refineries are operating with remarkable stability. Despite a few planned and unplanned outages, throughput and utilization rates remain strong, signaling a resilient refining sector. In July, U.S. refinery throughput averaged 16.9 million barrels per day, a slight dip from June but still robust. The only major planned outage is at Marathon’s Canton refinery, expected to last until mid-September. Other disruptions have been brief and localized, with minimal impact on national output.

The Gulf Coast continues to lead in throughput, supported by strong diesel crack margins and minimal maintenance. On the West Coast, PBF’s Martinez refinery has ramped up to near full capacity, helping regional throughput reach 2.2 million b/d. However, the landscape is shifting. Valero’s Benicia refinery will close by April 2026, and Phillips 66’s Los Angeles refinery is set to shut down in late 2025. These closures are expected to tighten supply and increase reliance on imports, especially in California.

The East Coast saw a slight dip in utilization due to brief outages, while the Midwest remained steady aside from Canton’s maintenance. The Rocky Mountain region held firm with no major outages, and the West Coast continued its recovery. Meanwhile, secondary unit inputs—FCCs, hydrocrackers, reformers, and cokers—remain strong, supporting continued momentum in refined product output.

Sources:

- Platts, Oil Price Information Service

- Energy Information Administration (EIA)

- S&P Global

- JP Morgan