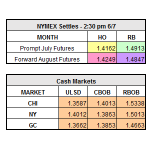

Amid expectations of a 3.5 million barrel decline, the surprising build in crude last week had led some analysts to question if OPEC cuts are actually impacting the market. We saw the market react to the large builds on diesel and gas all afternoon yesterday, but today it is trying to regain some ground.

Read MoreSurprise Build, Exempt Producers Have Bulls Wary