There appears to be a lot of uncertainty within the oil market right now. Of note right now in the market is the reduction of net long positions over the past three weeks.

Read MorePain and Not A Lot of Gain

Saudi Energy Minister Khalid al Falih said OPEC is in no hurry to deepen its current production cuts from current levels since its May 25th meeting. This strategy has not worked out for OPEC. August WTI has fallen over 16% since OPEC decided to prolong production cuts. Some analysts are saying that OPEC may soon […]

Read MoreSearching for a Direction

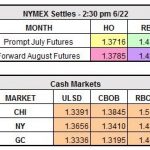

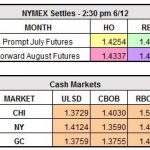

The market took a dive yesterday afternoon, but rebounded early this morning and is still trying to regain some ground. Yesterday the market closed down, front month HO down $0.0301 to $1.3648/gal, front month RBOB down $0.0135 to $1.4105/gal, and WTI Crude down $0.70 to $42.53/bbl.

Read MoreJumping Into The Bear Pit

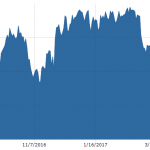

Those who believe that the bears are here to stay are buying into the sell-off this morning. As of 10:45 a.m., distillates and RBOB are trading down near 3 cents, while WTI crude sits right under $43 dollars per barrel. Those who like looking at graphs can see below that WTI crude just hit its […]

Read MoreTwenty Two Weeks of Increases and Counting

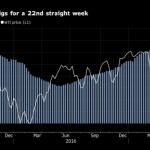

Many people have many different ways to view the number 22 around the world. It is said that the number 22, according to The Numerology, is the “most powerful of all numbers, able to turn lofty dreams into realities. It is confident, pragmatic, ambitious and disciplined.” Here in the U.S. the number 22 does represent […]

Read MoreNYMEX Gets Knocked Down, But It Gets Up Again..?

Oil prices are up slightly this morning after nearing 2017 lows, but have remained on course for a fourth straight week of losses. What’s driving these declines?

Read More45 and Falling

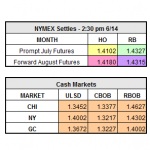

The market continued its downward motion early this morning, but currently is hovering around flat for both gas and heating oil. Yesterday the market closed down across the board, front month heating oil down $0.0375 to $1.4102/gal, front month RBOB down $0.0668 to $1.4327/gal, and WTI Crude down $1.73 to $44.73/bbl. One of the reasons […]

Read MoreTrading Wonky Ahead of Data-Weighted Wednesday

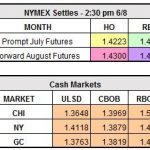

The oil patch traded as a mixed bag Tuesday as traders await Wednesday inventory data and a highly anticipated interest rate hike from the FOMC.

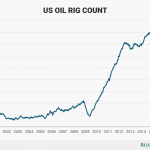

Read MoreOPEC Cuts or No Cuts, Producers Will Produce

The U.S. has yet again kept the streak alive by having another positive influx of rigs come online. Last week, Baker Hughes reports, oil rigs have increased yet again by a count of 8 and natural gas rigs have increased by 3. That brings crude rigs to a total of 741 and natural gas rigs […]

Read MorePotential Dollar Index Rebound May Pressure Crude

The oil complex is trading moderately higher today, but is facing potential dollar index headwinds as a result of the U.K. election yesterday and the FOMC, Federal Open Market Committee, meeting next week.

Read More