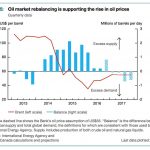

There seems to be a trend going on right now with inventory levels and the builds we have seen in the U.S. OPEC is saying all the right things to keep the market somewhat level but the elephant in the room is consumption. Hamza Khan, head of commodities strategy at ING has said, “You’ve got […]

Read MorePresumptions about Gas Consumptions