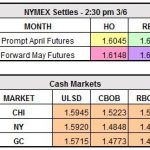

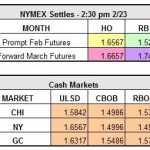

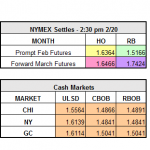

We have seen big changes in the market since last Thursday. Yesterday the April HO Contract closed at $1.5567/gal down $0.0572 and the April RBOB Contract closed at $1.6526/gal, down $0.0272. It is interesting to note in the last two weeks, subsequent to the DOE Reports, front month heating oil has closed over 5 cents […]

Read MoreBesides Price, How Does Guttman Energy Add Value to Customer Relationships?

Several years ago when Guttman Energy undertook the effort of updating our website, we spent a considerable amount of time evaluating what makes our company different from our competitors. We wanted our website to clearly reflect those differences so that our customers and prospects could see that there is more to a relationship with a […]

Read MoreTraders Cautious Ahead of Inventory Data

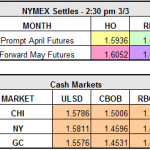

The short-covering rally continues today as futures prices in the oil complex trade higher before industry inventory data is published tomorrow. The primary driver of this rally is Libyan unrest and speakers at the CERAweek conference in Houston this week.

Read MoreCompliance, Rigs, Interest Rates…..

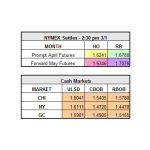

The oil market is looking for firm direction this morning as it digests the usual stories, numbers and rumors. As has been the focus over the past few months this list of topics include OPEC/non-OPEC compliance versus U.S. production, Trump administration news and a possible Federal Reserve interest rate increase later this month.

Read MoreCome On, Give Us a Hint: What’s Next?

The dollar is weakening this morning, which is putting slight upward pressure on oil prices at the moment. According to Tamas Varga, senior analyst at PVM Oil Associates, “The market is range bound, therefore there is nothing surprising in seeing fresh buying after a big sell-off and of course the slightly weaker dollar is also […]

Read MoreWinter Over? Summer Around the Corner?

As we enter the home stretch of the week, the April HO Contract closed down $0.0158 at $1.6241/gal and April RBOB Contract at $1.6780/gal, closing down $0.0514 from yesterday. As of 11:30 a.m. ET the market is continuing its slide in the refined products. April HO is trading at $1.5912/gallon and front month RBOB at […]

Read MoreBlend. RINs. Repeat.

The Trump Administration announced today a pending executive order that will change the refined products industry. The order will shift the responsibility of blending biofuels from the refineries to position holders at the petroleum terminals. This news has caused refined products and Renewable Identification Numbers (RINs) to trade lower on the day. April RBOB is […]

Read More(Cut) Amounts > (Rig) Counts=Price Bounce

Baker Hughes released the most recent rig count this week, and no surprise, it’s continuing to increase. With OPEC production cut compliance at an estimated 90% and increasing price, shale producers are drilling at a rapid pace. Over the last two weeks, the U.S. shale rig count has increased by 15 and reached the highest […]

Read MoreBig Changes On The Futures Market

All of this OPEC production cutting has affected the oil futures market and subsequently the traders that have benefited from the oil glut over the past three years. The big change that has occurred is that the crude oil futures curve has flipped from being in “contango” to almost a “backwardated” market, which is encouraging […]

Read MoreWhat Goes Up… Must Come Down?

To no surprise, the world of oil seems to be primarily focused on where prices are headed next. Since oil prices have been range-bound for quite some time now, the question at hand is, can we expect to see significant upside/downside in the market, or will crude be stuck in limbo between $50-60 indefinitely?

Read More