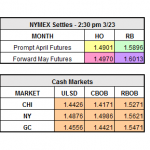

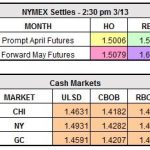

Early this morning the market looked like it was going to lose some of what it gained over the past three days, but this assumption was soon proven false. Keep an eye on the market if you step away from your desk even for a moment because it has already jumped up a penny. An […]

Read MoreKey Insights from Guttman Energy’s 2017 Energy Forum

On Wednesday, March 22nd Guttman Energy hosted its 2017 Energy Forum in Canonsburg, PA, the energy epicenter of Pennsylvania. We’d like to thank our customers and business partners who attended. For those of you who weren’t able to attend, following are highlights of the presentations delivered by our guest speakers.

Read MoreJust What The Doctor Ordered

All eyes are on the U.S. House of Representatives today, as our nation tries to close the books on the topic of healthcare. Congress is in session again, to determine whether the Affordable Care Act should be changed, replaced or left the way it is. It is clear that the Trump administration wants “Obamacare” gone […]

Read MoreTaking a Breather

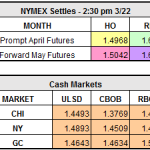

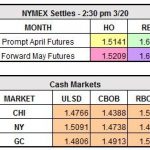

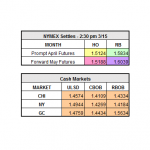

A day after digesting the Department of Energy stats and after many days and weeks of volatility the market seems to be taking a breather thus far today with all oil market indices except RBOB (down ~ $.0100) hovering somewhat flat. As was reported in this space yesterday, the DOE stats were in-line with Tuesday […]

Read MoreCrowded Crude Inventories at Cushing Causing Concern

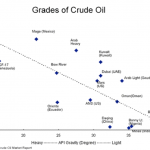

Does anyone have some room for crude oil? Oil prices reversed to trade lower mid-morning as the major U.S. stock market indexes sharply sold off despite a weaker U.S. dollar. But a larger component could be attributed to the swelling U.S. crude inventories and concern that we’re running out of available storage capacity.

Read MoreHeavy Cuts Make for a Sweet Market

January 3rd, 2017 marked the day that the U.S. dollar hit its highest peak in fourteen years. As of today the U.S. Dollar is down 4% from its January apex of 103.8. The falling of the U.S. dollar makes dollar-denominated commodities more expensive compared to buying them in other currencies, which contributes to the inverse […]

Read MoreMarch is Full of Madness

As many people are busy filling out their NCAA Basketball Tournament brackets, energy analysts are diligently trying to understand and predict what the futures market will do next. The DOE’s were released yesterday and finally put a halt to the nine week streak of crude builds. Crude inventories drew 237,000 bbl, surprising analysts who expected […]

Read MoreUncertainty Abounds

Today can be classified as full of uncertainty and uneasiness all around the world. Oil traders are again worried that U.S. storage will run out of capacity. Snowstorm Stella is wreaking havoc across the Northeast. China, Japan, North Korea, and the U.S. are uneasy over each other’s movements in the South China Sea. All of […]

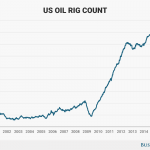

Read MoreRig Count: Onward & Upward

As we start this new week at almost the midway point of March, there is a lot going on. The main focus falls upon U.S. Shale vs. OPEC. There was a jump in the rig count for the eighth straight week. Total rig count is the highest since September of 2015. U.S. drillers have activated […]

Read MoreWhen Will Oil Fall Below.. Oh Wait…

Oil has indeed settled below $50 for the first time in 2017. When crude settled at $50.23 on Wednesday, there may have been some who were thinking “is this the new bottom for the oil?” Everyone wants to know whether the market has found a new bottom and if so, how long it will last.

Read More