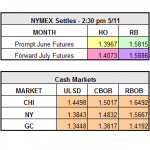

With the return of some Canadian oil sand production, the market is currently trading down about a cent and a half, respectively, on both HO and RBOB. Yesterday we saw another rally after the release of EIA data, which contradicted the API expectations of a 3.5 million bbl build. The EIA data showed a fall […]

Read MoreWill Supply and Demand Rebalance This Year?