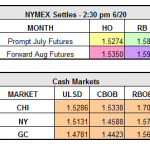

The market is retreating this morning after a 10.5 cent rally on HO and an 11.7 cent spike on RBOB the past two trading days, currently trading down 3 cents on refined products, respectively. Yesterday, HO advanced $0.0457 to $1.5274, and RBOB gained $0.0774 to $1.5827. July WTI crude finished up $1.39/bbl to $49.37. API […]

Read MoreWill A Brexit Affect Oil Markets?