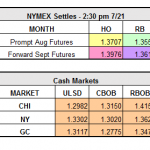

Yesterday, HO settled down $0.0347 to $1.3707 and RBOB finished down $0.0087 to $1.3550 (lowest since early March). August WTI crude lost $1.00 to $44.75, reaching a low of $44.25/bbl during overnight trading, a level that we haven’t seen since May. With U.S. inventories remaining at the forefront of oil price concern, trading is continuing […]

Read MoreU.S. Exports Rising, OPEC Exports Falling