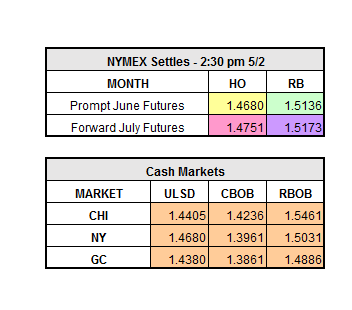

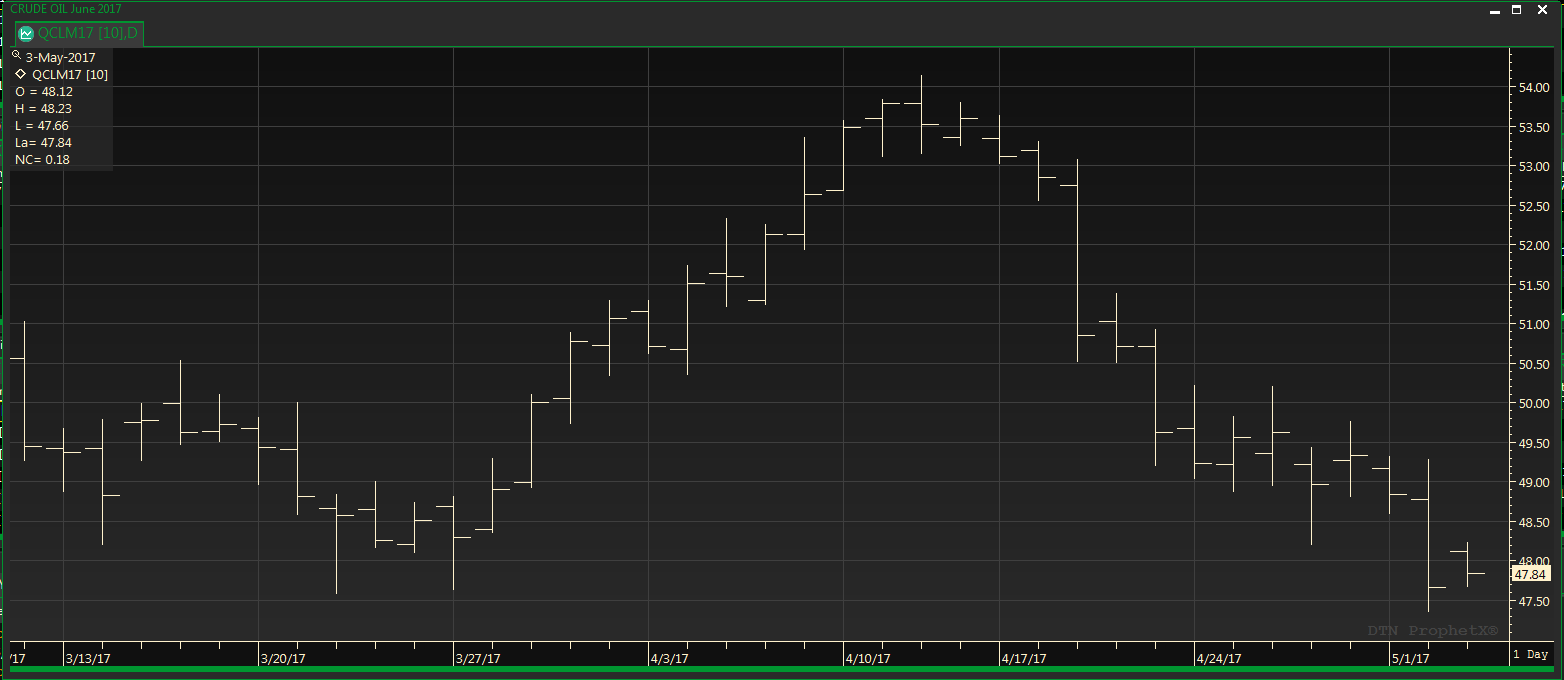

Yesterday, WTI crude closed down $1.18 to $47.66/bbl, RBOB closed down $0.0136 to $1.5136/gal, and HO finished down $0.0198 to $1.4680/gal. The WTI contract settled at a new six week low (see chart below). Weakness in the market was a result of news that Libya’s production is up to 760,000 barrels per day, which is the highest since the end of 2014. Production at the Sharara and El Feel oil fields could restart soon and help with Libya’s plan to reach 1.1 million barrels per day. Also contributing to weaker prices yesterday were the continued uncertainty around OPEC’s decision whether to extend the production cut through the end of the year and rising production in the U.S.

The API statistics released Tuesday were bullish, and had oil prices rebounding last night into this morning. The API statistics showed draws across the board. Crude inventories drew 4.2 million barrels, more than double of what was expected. Gasoline inventories drew 1.9 million barrels, and distillates drew 436,000 barrels. Tamas Varga, an analyst at PVM Oil Associates, stated, “The API statistics are helping the market recover, but the underlying sentiment is still bearish.” This proved to be true as the market slipped back down as it awaited the DOE statistics.

The DOE statistics released at 10:30 a.m. ET were a bit surprising and less bullish. The stats showed a draw of only 930,000 barrels in crude inventories. Gasoline actually had a build of 191,000 barrels, and distillates had a draw of 562,000 barrels. Demand for refined products is strong. After the release of the DOEs, the market is relatively flat. As always, it will be interesting to see what new bullish news can influence the fundamentally bearish market.