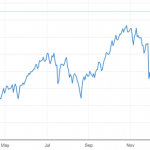

Inflation has accelerated in March to 8.5% when compared with 2021. To no one’s surprise, this level of inflation was driven by spikes in both energy and food. Simultaneously as the global supply chain tightens, combined with lockdowns in China, the cost to move everything everywhere continues to increase. Additionally, for the first time since […]

Read MoreMarching Up Inflation