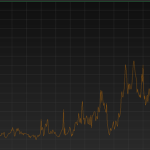

Reduced refining capacity combined with weather and geopolitical intrigue have eroded diesel stockpiles in the United States to noteworthy lows. Between the years of 2017 and 2021, the U.S. averaged 34 days of distillate supply, compared to just 25 days as of October 2022. Accordingly, while the price of gasoline has increased roughly 14% this […]

Read MoreDiesel Price Premium Hits All-Time High Over Gas, Crude Oil