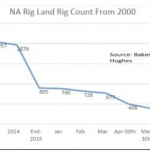

Oil and gas explorations remain sluggish and failing to rebound as expected. At $40+ a barrel and positive market indicator would historically promote conditions for the industry to recover, however there has been no indication of a recovery to speak of. The new normal seems to be a slim, budget conscious, and efficient industry soup […]

Read MoreSlim in…for good?