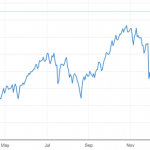

Crude and retail prices, despite the usual market fluctuations, have been on a steady decline over the last two months. Brent crude peaked in early March at over $125/barrel and exceeding $120/barrel again in June. WTI crude was much the same, surpassing $120/barrel in both March and June. Brent and WTI, year-to-date, have hit 28 […]

Read MoreWith crude and retail prices dropping, what does the future hold for consumers?