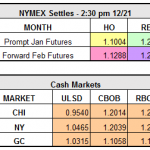

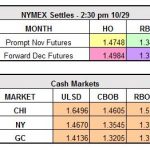

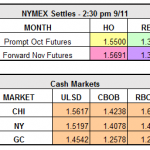

Yesterday saw further declines in the refined products in the front months. January RBOB futures settled down 6.52 cents and the January HO contracts settled down 67 points. Yesterday was also the last trading day for Jan WTI contracts. Trading was therefore very light in the Jan contract, but the Feb contract settled at $35.81 […]

Read MoreAnother Ruby Tuesday? Futures Prices in the Red Again